- Joined

- 17 November 2010

- Posts

- 4

- Reactions

- 1

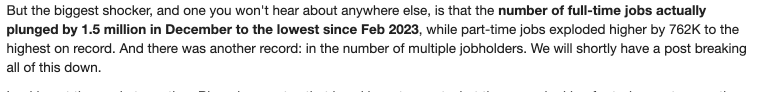

Currently, over the past 12 months, 20% of the American working population have filed a claim for unemployment benefits. That is 24.5 million claims over a 52 week period, with the working population stated as 125.8 million people.

One problem with the US is that the working population is declining as the total population is increasing.

The population of the US is about 310 million people, and only 126 million are in the workforce. And of the workforce, the official unemployment rate is 9.6%, ranging up to 16.7% depending on your definitions.

So from the peak in 2001, 4.5 % (or 13.8 million) of the population have left the workforce and are not looking for work. Add in 12 million to 21 million unemployed (depending on definitions) then you realize that a serious amount of income has been withdrawn from the economy.

Too often we get caught up in the sound bits about unemployment statistics, when any business/household knows it is really about the cashflow you can generate and how many mouths you have to feed.

One problem with the US is that the working population is declining as the total population is increasing.

The population of the US is about 310 million people, and only 126 million are in the workforce. And of the workforce, the official unemployment rate is 9.6%, ranging up to 16.7% depending on your definitions.

So from the peak in 2001, 4.5 % (or 13.8 million) of the population have left the workforce and are not looking for work. Add in 12 million to 21 million unemployed (depending on definitions) then you realize that a serious amount of income has been withdrawn from the economy.

Too often we get caught up in the sound bits about unemployment statistics, when any business/household knows it is really about the cashflow you can generate and how many mouths you have to feed.