- Joined

- 22 August 2016

- Posts

- 2

- Reactions

- 0

Hi All,

I've got a quick question regarding the report the ASX provide covering the LICS vs NTAs.

e.g. http://www.morningstar.com.au/s/documents/201607_ASX-LIC-NTA-Report.pdf

So from what I can tell ideally it is best to buy LICs when it is trading at a discount to the underlying NTA.

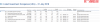

I'm just trying to understand the report, going by the below image are the LICs that are trading at a discount having a negative value in the Prem/Disc Post-Tax NTA % column such as ACQ and ALR hinting they are undervalued and a good buy at the time?

I'm looking to invest into a LIC long term, a set and forget investment. Ideally from what I can tell either AFI or ARG when the time is right. Trying to work that out now.

Thanks

I've got a quick question regarding the report the ASX provide covering the LICS vs NTAs.

e.g. http://www.morningstar.com.au/s/documents/201607_ASX-LIC-NTA-Report.pdf

So from what I can tell ideally it is best to buy LICs when it is trading at a discount to the underlying NTA.

I'm just trying to understand the report, going by the below image are the LICs that are trading at a discount having a negative value in the Prem/Disc Post-Tax NTA % column such as ACQ and ALR hinting they are undervalued and a good buy at the time?

I'm looking to invest into a LIC long term, a set and forget investment. Ideally from what I can tell either AFI or ARG when the time is right. Trying to work that out now.

Thanks