You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

how do you trade the VIX

i notice that the Vix is listed to 2 decimal places yet in a demo account i was trialing, it was trading to 1 decimal place and without the real volatility that the vix chart displays elsewhere

You can buy VXX.US which is an ETF that is meant to track the vix index.

IG market offers a synthetic CFD on the volatility index but their numerical value is different. Not sure how well it tracks the underlying.

Seems in every "how do you trade X instrument" thread on ASF there is someone happily suggesting the use of NYSE ETFs to track.

Once again, if you want to trade the instrument, trade the instrument. Trading these retail ETF will have your position murdered if your holding time is >1 day.

I doubt even the IG VIX CFD tracks this poorly.

Once again, if you want to trade the instrument, trade the instrument. Trading these retail ETF will have your position murdered if your holding time is >1 day.

I doubt even the IG VIX CFD tracks this poorly.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Seems in every "how do you trade X instrument" thread on ASF there is someone happily suggesting the use of NYSE ETFs to track.

Once again, if you want to trade the instrument, trade the instrument. Trading these retail ETF will have your position murdered if your holding time is >1 day.

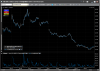

View attachment 42104

I doubt even the IG VIX CFD tracks this poorly.

Great chart. Is your VIX chart the index itself or the front month future? VXX "meant" to track the short term VIX future so would that account for some of the divergence? What does the 1 month picture look like?

nukz

888

- Joined

- 27 July 2008

- Posts

- 253

- Reactions

- 0

Depends who your provider is but i've traded the VIX, its a pretty fundamental index eg. earthquakes in Japan or stuff happening in middle east make it spike up easily so its not that hard to trade.

I traded it only during these recent periods of Libya and Japan quake but ushally i just use it as a indicator as to how the markets are doing.

When it hit 30 a few weeks back i know not to trade cos its almost a given i will go into a margin call lol or rather i wont leverage up too much

I traded it only during these recent periods of Libya and Japan quake but ushally i just use it as a indicator as to how the markets are doing.

When it hit 30 a few weeks back i know not to trade cos its almost a given i will go into a margin call lol or rather i wont leverage up too much

Great chart. Is your VIX chart the index itself or the front month future? VXX "meant" to track the short term VIX future so would that account for some of the divergence? What does the 1 month picture look like?

The chart shown is the index itself. Curious minds can take a look/run comparison at individual VIX futures by searching "VI*" on barchart.com.

The 1 month picture is irrelevant, people need to realise that ETFs/ETNs on futures/options/whatever are derivative of derivative of derivative products, and they will not track nor are they designed to provide the same exposure of the futures/options/whatever. Otherwise I would just accumulate huge unleveraged longs in VXX every time it made a 20 day low and wait for the inevitable spike off at any point in the future.

This article was written 7 days ago, worth reading if you aren't convinced that derivative of derivative ETFs are not the same as the actual instrument!

http://www.businessinsider.com/examining-vix-etf-performance-during-a-sell-off-2011-3

Snippet:

While exposure to the VIX has appeal, it’s important to note that exposure to the spot VIX still isn’t possible; as mentioned above, the value of this index is derived not from prices of component securities but from the prices of options on equity indexes. So the ETPs found in the Volatility ETFdb Category actually invest in VIX futures (on, in the case of ETNs, are linked to indexes comprised of VIX futures). This feature is necessary to make exposure possible, and it means that performance of these products depends on factors beyond the performance of the spot VIX–including the slope of the VIX futures curve.

The events of the last week–including steep equity market declines in the wake of the Japanese earthquake and ongoing tensions in the Middle East–presented an opportunity to analyze how the nuances of a futures-based strategy and other features of VIX ETPs translate into bottom line performance.

Last Wednesday was a dismal session for equities, with the S&P 500 SPDR (SPY) dropping close to 2% on the day as worries about a full-blown nuclear crisis in Japan intensified. Not surprisingly, as anxiety about global equity markets spiked so too did the VIX; the “fear index” was up more than 20% on the day. Many volatility products also saw big swings during that session; below, we take a look at how many of the exchange-traded volatility products performed as the VIX was skyrocketing.

One way of bifurcating VIX products involves segmenting by the duration of the underlying futures products into short-term and mid-term. Short term products, such as VIXY and VXX, generally offer exposure to a position in first and second month VIX futures. Mid term products, such as VIXM and VXZ, will offer exposure to fourth month contracts through seventh month contracts. There are pros and cons to each type of product. Short-term exposure will generally exhibit higher correlation to changes in the spot VIX. But because contango is often steepest at the short end of the maturity curve, the adverse impact of an upward-sloping curve may be more severe.

On the day the VIX jumped 21%, the ProShares VIX Short-Term Futures ETF (VIXY) surged about 9%–a huge gain but a jump considerably smaller than the movement in the spot VIX. Again, that disconnect reflects not a flaw in the exchange-traded product, but the difference in the risk/return profile of the VIX compared to an index comprised of VIX futures.

The mid-term counterpart to VIXY, the VIX Mid-Term Futures ETF (VIXM) climbed about 3% during Wednesday’s session. That move reflected expectations for the level of the VIX several months down the road. As such, VIXM tends to exhibit less volatility than VIXY or the spot VIX.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

The chart shown is the index itself. Curious minds can take a look/run comparison at individual VIX futures by searching "VI*" on barchart.com.

The 1 month picture is irrelevant, people need to realise that ETFs/ETNs on futures/options/whatever are derivative of derivative of derivative products, and they will not track nor are they designed to provide the same exposure of the futures/options/whatever. Otherwise I would just accumulate huge unleveraged longs in VXX every time it made a 20 day low and wait for the inevitable spike off at any point in the future.

This article was written 7 days ago, worth reading if you aren't convinced that derivative of derivative ETFs are not the same as the actual instrument!

http://www.businessinsider.com/examining-vix-etf-performance-during-a-sell-off-2011-3

Snippet:

Great info.

If I interpreted this correctly it is saying that you can't track the VIX index perfectly because it simply isn't a tradable instrument.

You can however trade the VIX futures... which I assume is what you were suggesting.

The VXX ETF actually appear to track the VIX Apr contract reasonably well over the last 2 weeks.

Great info.

If I interpreted this correctly it is saying that you can't track the VIX index perfectly because it simply isn't a tradable instrument.

Yep nobody can trade VIX spot, well I guess you could, by buying or selling all the weighted option components of VIX!

You can however trade the VIX futures... which I assume is what you were suggesting.

Futures, or options on the futures.

Check here how the futs are settled (it's an interesting mechanism)

http://cfe.cboe.com/Products/settlement_VIX.aspx

So you can/should be able to settle futs and options relatively close to spot.

The VXX ETF actually appear to track the VIX Apr contract reasonably well over the last 2 weeks.

View attachment 42111

For short term stuff, the ETF/ETP/ETN range is relatively fine as I stated, although my guess is if you were holding VIX futs around the Japanese earthquake, you would be literally twice as happy as holders of VXX. This is the point! Why miss out on the actual % move of the underlying unless your capital is too small to trade the fut, in which case you probably shouldn't be attempting to buy/sell volatility in the first place (let's face it, if you are putting a thread on ASF asking how to trade the VIX, you probably shouldn't be attempting it either).

If you wanna put 10% of your portfolio into VXX because you think it will act as a rolling hedge, or you wanna "buy and hold" volatility, this is not the way to do it.

- Joined

- 18 June 2010

- Posts

- 277

- Reactions

- 0

you cant get direct exposure to VIX because the futures prices (see above) are usually above VIX itself, and converge over time till expiry there is no gap. This means if you want to be long of VIX you start with an inbuilt handicap to get over of having to 'buy' it at 1.91% over spot vix (in the case of the april futures above), and other things being equal every day that futures price will converge a little with spot, meaning you lose money when spot stays still. Its a bit like owning an option and losing a bit of time value each day, except your losses arent limited.

in fact other things being equal ie index stays still, VIX will usually fall a bit AND future will converge with spot a bit, so you lose twice.

If you buy a VIX call option instead you can now lose three ways when the index stays still; every day you can lose some time value on an option based on a futures price which is falling towards a spot price which has probably dropped a little as well.

If it was possible to get direct exposure to VIX in some way at the spot price then you could make a fortune selling VIX calls at 21.95 and hedging wth a long at 17.91

Then we could all retire. So please let me know if you find it.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

For short term stuff, the ETF/ETP/ETN range is relatively fine as I stated, although my guess is if you were holding VIX futs around the Japanese earthquake, you would be literally twice as happy as holders of VXX. This is the point! Why miss out on the actual % move of the underlying unless your capital is too small to trade the fut, in which case you probably shouldn't be attempting to buy/sell volatility in the first place (let's face it, if you are putting a thread on ASF asking how to trade the VIX, you probably shouldn't be attempting it either).

I don't think that is the point.

The article compared the spot VIX (which we agree that it can't be traded unless re-constituted with basket of options) to the ETF and looked at the difference in performance. Not the ETF vs the VIX future.

On the day the VIX jumped 21%, the ProShares VIX Short-Term Futures ETF (VIXY) surged about 9%–a huge gain but a jump considerably smaller than the movement in the spot VIX. Again, that disconnect reflects not a flaw in the exchange-traded product, but the difference in the risk/return profile of the VIX compared to an index comprised of VIX futures.

So given that you can't easily be exposed to the movement in the spot VIX. The best you could do is to trade VIX front month future, which the VXX tracks reasonbly well even during the earthquake (as the chart showed).

- Joined

- 22 July 2009

- Posts

- 602

- Reactions

- 0

If you wanna put 10% of your portfolio into VXX because you think it will act as a rolling hedge, or you wanna "buy and hold" volatility, this is not the way to do it.

Because of the term structure inherent in the futures, you should trade vega via futures calendar spreads [long front month/short back month (short var) or vice versa (long var) or time flies] to negate the contango/backwardation, rather than the long/short the future itself.

I have a buddy who trades the VIX - long vega to the downside in SPX and then sell vega synthetically using the futures in VBI. Why not SPX vols? The skew is hard to overcome. Most of the trading is to take advantage of convergence gains [as mentioned by above posters] and model edge [model the term structure].

Because of the term structure inherent in the futures, you should trade vega via futures calendar spreads [long front month/short back month (short var) or vice versa (long var) or time flies] to negate the contango/backwardation, rather than the long/short the future itself.

mazza, great suggestion, thought you might turn up before long

village idiot, isn't what you're describing the case with all futs which have upward sloping maturity curves? Settle at spot, or pay the future premium...not an issue with the product, each trader/investor must due their due diligence and decide whether or not to place the order.

skc, ok goodluck with that

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

skc, ok goodluck with that

Good luck with what? I am not the one trading VIX.

- Joined

- 22 July 2009

- Posts

- 602

- Reactions

- 0

Good luck with what? I am not the one trading VIX.

The most direct way is via the futures, rather than ETF's is his point. Even the options on the futures become a derivative of a derivative - VIX synthetics [conversion/reversal pricing in the ops] sometimes doesn't align with VBI futures. ETF's, well they become more convoluted...

@sinner - yeah mention vol and my eyes light up!!!

- Joined

- 18 June 2010

- Posts

- 277

- Reactions

- 0

mazza, great suggestion, thought you might turn up before long

village idiot, isn't what you're describing the case with all futs which have upward sloping maturity curves? Settle at spot, or pay the future premium...not an issue with the product, each trader/investor must due their due diligence and decide whether or not to place the order.

skc, ok goodluck with that

sinner, i dont know much about commodity futures so that may well be the case in some commodities for various reasons. But taking indices as an example, the premium of futures over spot is basically the cost of carry, or interest rate less divs, which usually produces an upward sloping curve. this means as long as future is trading around fair value one would be indifferent between buying spot and wearing the cost of carry, or buying the future price. If it isnt then arbitrage is possible because you can buy at spot in various ways.

from my limted knowledge i believe most commodities are the same unless there is some reason otherwise such as harvest or transport conditions or something.

with VIX however the futures premium (in normal conditions) by far exceeds any interest cost, and I would not be at all indifferent between buying at the forward price v at spot, if such a thing were possible

- Joined

- 18 June 2010

- Posts

- 277

- Reactions

- 0

i am just wondering if you could in fact simulate being long VIX at around the spot price by buying SPX options , hedged delta neutral, and continuously adjusting the hedge to remain dn. In theory, assuming the realised vol is roughly the IV you bought at, the adjustments should offset the time decay, leaving you vega+ but more importantly a beneficiary of any sudden large moves by way of intrinsic value as well as vega.

right now SPX atm straddle is about 17% IV (using mid price) which if anything is below VIX right now. so buy that, delta hedge, and sell the june VIX at 21.85 and harvest the difference one way or another.

what do you think mazza?

edit; or is that basically what you are saying your buddy does?

right now SPX atm straddle is about 17% IV (using mid price) which if anything is below VIX right now. so buy that, delta hedge, and sell the june VIX at 21.85 and harvest the difference one way or another.

what do you think mazza?

edit; or is that basically what you are saying your buddy does?

- Joined

- 22 July 2009

- Posts

- 602

- Reactions

- 0

@vi

Yes and no.

What I described before is analogous to gamma scalping but with vega instead. It is long vega to the downside in the index, short vega in VBI futures calendars until the desired amount of long vol is achieved.

The difficult variable in the model is vvols, rather than vol, hence you need to understand the VIX term structure to determine fairval and convergence risk. In this case a "compare rv to iv" methodology isn't directly transferable to trade the VIX.

I haven't modeled your scenario, but its not ideal to hedge SPX vol with VIX forward vol and contango. It's very similar to fixed income tenors.

Yes and no.

What I described before is analogous to gamma scalping but with vega instead. It is long vega to the downside in the index, short vega in VBI futures calendars until the desired amount of long vol is achieved.

The difficult variable in the model is vvols, rather than vol, hence you need to understand the VIX term structure to determine fairval and convergence risk. In this case a "compare rv to iv" methodology isn't directly transferable to trade the VIX.

I haven't modeled your scenario, but its not ideal to hedge SPX vol with VIX forward vol and contango. It's very similar to fixed income tenors.

- Joined

- 18 June 2010

- Posts

- 277

- Reactions

- 0

interesting just looking at long vega to the downside. but I guess if trying to simulate long vix there is no need to be long vega if index stays still or rises, as vix isnt going up in those circumstances anyway.

a put backspread seems to fit the bill; long vega to the downside, dropping to neutral on the upside. delta neutral on the upside, delta short to the downside. how would you offset time decay though, or is that the job of the VIB futures calendars?

is that the sort of thing you mean?

a put backspread seems to fit the bill; long vega to the downside, dropping to neutral on the upside. delta neutral on the upside, delta short to the downside. how would you offset time decay though, or is that the job of the VIB futures calendars?

is that the sort of thing you mean?

- Joined

- 22 July 2009

- Posts

- 602

- Reactions

- 0

Yes you are negating the bleed in SPX, via long/short vbi calendars. These calendars are no different to commodity future spread plays when playing convergence risk.

Yeah you could use the put backspread. As far as I am aware he juts buys puts. You don't have to be delta neutral - just take advantage of the inverse relationship between bear deltas and vol and being cognizant of the skew [i.e. not go out too deep].

Yeah you could use the put backspread. As far as I am aware he juts buys puts. You don't have to be delta neutral - just take advantage of the inverse relationship between bear deltas and vol and being cognizant of the skew [i.e. not go out too deep].

- Joined

- 18 June 2010

- Posts

- 277

- Reactions

- 0

this is an interesting subject. came accross couple of articles pertinent to subjects raised here;

http://www.futuresmag.com/Issues/2010/September-2010/Pages/Understanding-VIX-futures.aspx

then there is this article proposing the same (long spx options delta hedged) v (short VBI futures) I speculated on above;

http://www.benzinga.com/10/07/393258/trading-the-vix-futures-spread

however I am now liking mazzatelli's idea of using a VIX futures cal spread instead. At first glance the risk;reward seems superior to either short futures or short calls, but i am having trouble modelling the 'risk' as i am not sure what behaviour the spread would have in times of trouble.

so what do you reckon is the worst case that can happen to a futures spread? In other words what would be the widest a near/mid month spread could get either in contango or backwardation?

http://www.futuresmag.com/Issues/2010/September-2010/Pages/Understanding-VIX-futures.aspx

While the value of the VIX, which is generally accepted as a broad measure of market volatility, is derived from prices of S&P 500 index options, it is not simply a weighted sum of underlying options (unlike other equity indexes like the S&P 500, where the index is a weighted sum of component prices). The options from which VIX is calculated sum up to the square of VIX, not VIX itself. This non-linear transformation means that you cannot just buy or sell a basket of options whose expiration price equals the index. Because of this non-linear component, there is no way to statically replicate the VIX.

Because the underlying VIX is not tradable, the futures on the VIX are not tied by the usual cost of carry relationship that connects other indexes and index futures. To price the futures that have no tradable underlying, we must follow a statistical approach based on various factors: the distribution of the VIX, the strength of the trend, mean-reversion and volatility. In a sense, VIX futures are much like options, having their own set of Greeks.

then there is this article proposing the same (long spx options delta hedged) v (short VBI futures) I speculated on above;

http://www.benzinga.com/10/07/393258/trading-the-vix-futures-spread

however I am now liking mazzatelli's idea of using a VIX futures cal spread instead. At first glance the risk;reward seems superior to either short futures or short calls, but i am having trouble modelling the 'risk' as i am not sure what behaviour the spread would have in times of trouble.

so what do you reckon is the worst case that can happen to a futures spread? In other words what would be the widest a near/mid month spread could get either in contango or backwardation?

Similar threads

- Replies

- 15

- Views

- 2K

- Replies

- 8

- Views

- 1K

- Replies

- 27

- Views

- 1K

- Replies

- 35

- Views

- 2K