- Joined

- 17 November 2016

- Posts

- 4

- Reactions

- 2

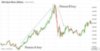

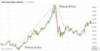

Many believe that the timing of an investment is not important or not relevant for a long term investment. Therefore, people believe that losing money for a short period of time is justifiable. . This belief is for those who fail to get their timing right!. Many people only actively select and buy a stock. But once they are holding the stock, they become passive and are not concerned about what is happening in the market. Successful investment in stocks, is not only choosing the right stock, but buying the right stock at the right time. Look at the chart below. Even on an uptrend market, person A who buys at the right time (at the beginning of trend) will make money; compared to person B who buys the same stock but at the wrong time ( at the beginning of a pullback). As a result, person B makes a loss with the same stock.

Jess Levermore, the Wall Street legend once said: "It is not as important to buy as cheap as possible as it is to buy at the right time"

Making a right trading decision does not only mean buying at a good price but also buying at the right time. Timing is the key element in Cycle Timing Analysis. This technique helps us to determine or pinpoint the turning point in terms of the timing of upwards and downwards trends? Knowing the entry price is one thing, however knowing when to buy a stock is also crucial in order to maximise profits and prevent losses.

There are many investments that do not provide a return, even though you have invested for many years. For example, Melbourne IT is an Australian internet company listed on the Australian Securities Exchange, which once traded above $16.00 per stock in the year 2000. Many investors invested their hard earn money based on the recommendation of the brokers. They went in with full confidence that their investments will pay off with good returns after a long-term holding. However, after 15 years of waiting, they have come to the state of despair, as the stocks are now worth less than $2.00 (in 2015).

Another example of misguided investment is HIH Insurance. The company was Australia’s second-largest insurance firm. The media was full of broker’s recommendations to buy the company’s shares when they dropped from $3.50 to $2.00, causing a high buying volume at that time. However, if you, unfortunately, did make those investments at the time, you would come to know that at 6 years later, the shares have dropped to below $0.50, and the company sliding to an almost bankrupt state.

HIH's Share Price | Source

How about the large, global, well-known large enterprise Microsoft Corp (MSFT)? Microsoft’s stock hit $58 back in 1999. During the dot-com bubble, it declined to below $20. It took more than one and half decades for it to rise back to $55.

These are just examples of 2 so-called “long-term” investment companies, which were deemed “safe”. It’s not always accurate to say that buying-and-holding an investment long-term will always give you a good return. Even if the investment bumps back up to past the original price, you may have lost years of time waiting for it to recover; which is money that could’ve been helping you generate profits elsewhere. Therefore, be sure that you don’t fall into the trap of this myth. Pinpointing the most accurate time to buy and sell stocks requires a combination of fundamental, technical and timing cycle analysis skill.

Last edited by a moderator: