wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,130

- Reactions

- 13,608

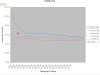

I will post the excel spreadsheet I'm working on here and we can discuss how to use a volatility cone. As a primer here is a bit of blurb from amex (one of the US options exchanges)

... and a reminder that you can access IV/SV charts via this link http://sigmaoptions.netfirms.com/IVcharts/stockIV.htmVolatility Cone

A technique for visualizing current option implied volatility relative to historic volatilities at different maturity ranges. This technique, developed by Galen Burghardt, uses the range of historic volatilities for each option's maturity from, say, one month to two years or longer, depending on the maturities of instruments available in the market. An historic volatility series is calculated for each period and 25% and 75% confidence intervals on either side of the mean historic volatility line are added. When the current implied volatility term structure is drawn on this diagram, the investor is able to determine how current option premiums compare to historic premium levels at various maturities.