tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,397

- Reactions

- 6,316

Ive noticed that over the years most who want to profit from Trading or Investing in Stocks

dont actually know how to apply the vast number of analysis options available to them

into a profitable trading Plan / Method.

Endless theories/ideas/hypothesis and constant changing from one idea

to the next when expectations are not met or fall alarmingly short.

Common sense and logic should prevail--right?

Over my own journey I have had a number of light bulb moments and Ill

share them with you here.

They were quite simply the building blocks for the Holy Grail---the light which turn dark into day.

Regardless of WHAT analysis you chose to use these lights will ensure you have the best

possible chance to profit. They will when implemented often change mediocre into spectacular.

Failure into the trash bin or on the road to better profit. You can implement what will be shown here IMMEDIATELY.

There are NO secrets as you will see.

This is not the be all and end all. It is not a system.

It is what you need to lift you beyond the smog of theory and out of the mud pit of confusion and indecision.

How you best implement it into YOUR way of trading is for you to decide.

I will show you but ONE WAY here.

Once you have this knowledge you have learnt "How to Fish".

The HTF can be applied to Systems but is probably best applied

to discretionary trading. All charts and trading in this exercise are discretionary

technical charts--we look both at the hard right of page and consider the left..

In the following I make a number of assumptions about you the trader.

You are decisive.

You are capitalized

You are organised and disciplined.

(1)

ITS NOT ABOUT BEING RIGHT.

ITS ABOUT BEING PROFITABLE.

Hrs pouring over balance sheets or studying charts in 4 different time frames

overlaying indicator after indicator on the page.

All the ducks line up.This IS the big one --- the mother lode.

How often it falls short. or fails to as much as glitter?

To be profitable we must either

Have far more winners with more profit than losers.

OR

Far bigger winners than accumulated losers

OR

A combination of BOTH.

(2)

STEPPING IN FRONT OF TRAINS.

There are endless ways to enter a trade. But for me personally I like to look for trains.

Stocks that are already on the move and can prove to me they are moving in my direction.

I have no idea if my train will keep at one speed---speed up or slow down or reverse.

All I can do from my analysis is "ANTICIPATE" where it is likely to go.

Entry

Exit

On the move

Thats all we can do is "Anticipate" what is likely to happen going forward.

We can from analysis have a high % of moves play out as analysed.

but we also have many that don't.

Its when things go astray that we need to get off the train.

Either JUMP off or Stand at the Door.

There will always be another train.

So if we jump in or off prematurely we will soon find another.

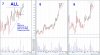

For this exercise I will be using Patterns and some VSA (Volume spread Analysis)

along with some conventional Technical analysis like Support and Resistance.

Some linear Regression Trends and Gaps. These I find useful in identifying

emerging and continuation patterns,Exhaustion and Looming Impulse moves.

At times when obvious Elliott.

Plus one of my own

CONTROL VOLUME.

But at all times it will be very simple.

(3)

TRADE AND PORTFOLIO MANAGEMENT

The Missing LINK.

This is by far the area where most fail.

The most important aspect of trading I wanted to get across to PAV and anyone else who is

struggling to make better than average returns.

Most know one way of position sizing is to use the Fixed Fractional Method (Google it for a clearer understanding)

This is the simplest way to determine initial risk and position size on a trade.

You can select whatever % of capital you wish to risk .5% for larger accounts/1/2/3% but 1 stop width is known as 1R. (Risk)

The resultant loss if the trade goes against you should never exceed 1 R if you adhere to your stop.

Your profit can then be expressed in terms of R (Reward) as a ratio if Risk. IE 1.5R your win is 1.5 X Risk.

I am constantly adjusting Risk from initial risk to potential draw down if a trade goes sour.

You will see in the Numbers of the trading exercise to date how this daily attention to Risk/Reward has skewed the

numbers in a more favorable manner to us the trader.

SEE Option (1) AND Option (2) Below

(4)

IMPROVING RESULTS

.

There are a few things we can do WITHOUT tinkering with the premise.

(Lower Risk and maximize Reward while increasing our win rate and decreasing our potential loss).

So one we have a profitable method

(1) Trade frequency--Increase it.

(2) Capital base --- increase it--margin perhaps

(3) Pyramid into profitable running trades--we have and will do this in the exercise.There are a number of ways of

managing Pyramid trades.

Now to the Results.

Over the last 5 mths we have had 48 trades

Losses are Red

Wins Are Green

Break-evens are Yellow

Setups that fail are Black--so you cant read them--Perhaps Pav you could make them BLUE

CLICK TO ENLARGE

Total trades - 35

Pattern fails – 12

Number of wins – 14

Option 1 - Number of losses (inlc be) – 21

Option 2 - Number of losses (without be) – 13

Average win – 2.61R ($1,307)

Average loss (option 1) = -0.46R (-$228)

Average loss (option 2) = -0.72R (-$361)

RR (option 1) = 2.19

RR (option 2) = 1.39

Initial capital = $25,000

Net profit = $13,500 exactly (27R)

Maximum drawdown

High

39,867

Low

38,500

1,366

5.46%

All record keeping and spreadsheets thanks to PAV!!

Good job.

Ill leave this to comment than move on to the trading.

Please Comment on the OTHER thread

dont actually know how to apply the vast number of analysis options available to them

into a profitable trading Plan / Method.

Endless theories/ideas/hypothesis and constant changing from one idea

to the next when expectations are not met or fall alarmingly short.

Common sense and logic should prevail--right?

Over my own journey I have had a number of light bulb moments and Ill

share them with you here.

They were quite simply the building blocks for the Holy Grail---the light which turn dark into day.

Regardless of WHAT analysis you chose to use these lights will ensure you have the best

possible chance to profit. They will when implemented often change mediocre into spectacular.

Failure into the trash bin or on the road to better profit. You can implement what will be shown here IMMEDIATELY.

There are NO secrets as you will see.

This is not the be all and end all. It is not a system.

It is what you need to lift you beyond the smog of theory and out of the mud pit of confusion and indecision.

How you best implement it into YOUR way of trading is for you to decide.

I will show you but ONE WAY here.

Once you have this knowledge you have learnt "How to Fish".

The HTF can be applied to Systems but is probably best applied

to discretionary trading. All charts and trading in this exercise are discretionary

technical charts--we look both at the hard right of page and consider the left..

In the following I make a number of assumptions about you the trader.

You are decisive.

You are capitalized

You are organised and disciplined.

(1)

ITS NOT ABOUT BEING RIGHT.

ITS ABOUT BEING PROFITABLE.

Hrs pouring over balance sheets or studying charts in 4 different time frames

overlaying indicator after indicator on the page.

All the ducks line up.This IS the big one --- the mother lode.

How often it falls short. or fails to as much as glitter?

To be profitable we must either

Have far more winners with more profit than losers.

OR

Far bigger winners than accumulated losers

OR

A combination of BOTH.

(2)

STEPPING IN FRONT OF TRAINS.

There are endless ways to enter a trade. But for me personally I like to look for trains.

Stocks that are already on the move and can prove to me they are moving in my direction.

I have no idea if my train will keep at one speed---speed up or slow down or reverse.

All I can do from my analysis is "ANTICIPATE" where it is likely to go.

Entry

Exit

On the move

Thats all we can do is "Anticipate" what is likely to happen going forward.

We can from analysis have a high % of moves play out as analysed.

but we also have many that don't.

Its when things go astray that we need to get off the train.

Either JUMP off or Stand at the Door.

There will always be another train.

So if we jump in or off prematurely we will soon find another.

For this exercise I will be using Patterns and some VSA (Volume spread Analysis)

along with some conventional Technical analysis like Support and Resistance.

Some linear Regression Trends and Gaps. These I find useful in identifying

emerging and continuation patterns,Exhaustion and Looming Impulse moves.

At times when obvious Elliott.

Plus one of my own

CONTROL VOLUME.

But at all times it will be very simple.

(3)

TRADE AND PORTFOLIO MANAGEMENT

The Missing LINK.

This is by far the area where most fail.

The most important aspect of trading I wanted to get across to PAV and anyone else who is

struggling to make better than average returns.

Most know one way of position sizing is to use the Fixed Fractional Method (Google it for a clearer understanding)

This is the simplest way to determine initial risk and position size on a trade.

You can select whatever % of capital you wish to risk .5% for larger accounts/1/2/3% but 1 stop width is known as 1R. (Risk)

The resultant loss if the trade goes against you should never exceed 1 R if you adhere to your stop.

Your profit can then be expressed in terms of R (Reward) as a ratio if Risk. IE 1.5R your win is 1.5 X Risk.

I am constantly adjusting Risk from initial risk to potential draw down if a trade goes sour.

You will see in the Numbers of the trading exercise to date how this daily attention to Risk/Reward has skewed the

numbers in a more favorable manner to us the trader.

SEE Option (1) AND Option (2) Below

(4)

IMPROVING RESULTS

.

There are a few things we can do WITHOUT tinkering with the premise.

(Lower Risk and maximize Reward while increasing our win rate and decreasing our potential loss).

So one we have a profitable method

(1) Trade frequency--Increase it.

(2) Capital base --- increase it--margin perhaps

(3) Pyramid into profitable running trades--we have and will do this in the exercise.There are a number of ways of

managing Pyramid trades.

Now to the Results.

Over the last 5 mths we have had 48 trades

Losses are Red

Wins Are Green

Break-evens are Yellow

Setups that fail are Black--so you cant read them--Perhaps Pav you could make them BLUE

CLICK TO ENLARGE

Total trades - 35

Pattern fails – 12

Number of wins – 14

Option 1 - Number of losses (inlc be) – 21

Option 2 - Number of losses (without be) – 13

Average win – 2.61R ($1,307)

Average loss (option 1) = -0.46R (-$228)

Average loss (option 2) = -0.72R (-$361)

RR (option 1) = 2.19

RR (option 2) = 1.39

Initial capital = $25,000

Net profit = $13,500 exactly (27R)

Maximum drawdown

High

39,867

Low

38,500

1,366

5.46%

All record keeping and spreadsheets thanks to PAV!!

Good job.

Ill leave this to comment than move on to the trading.

Please Comment on the OTHER thread