G'day folks,

In the past I have invested based purely on the business reports etc and recommendations on my shareholder site. This has yielded approximately 0% return over the past few years. So, over the past week or so while I have had time off work recovering from an operation, I decided to investigate other options and teach myself a bit about technical analysis. So I have put together some analysis that I conducted based on what I have taught myself and amy looking for feedback, particularly by skilled people but also by others that are just getting into tech analysis. I don't have a fancy trading platform for good analysis so please excuse the word art in this thread.

So I believe it is important to appreciate the macro environment before assessing individual shares. So first up is an assessment on the direction of XAO:

Macro climate

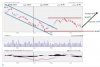

Using the XJO as the index to conduct the assessment.

After reaching a high in mid-May of 5,250 the ASX retreated to a low around 4,650 (representing a drop of 14%) in early/mid June. It rallied to a high a few days later of 4861 (gaining back 33% of its losses). It has again retreated to a low of 4683 (after the Ben Bernanke speech on QE). Some assessments “identified” a short run rising wedge prior to 21 Jun a predicting a long march down. However, the market on 21 Jun doesn’t indicate that the bears are strong enough (I say this based on the initial knee-jerk reaction to very quickly reconsolidate). Macro options assessed as:

Double bottom reversal – this would be indicated by a break above 4860 indicating the bulls have won out and the market is on the rise again. This is supported by pre-Bernanke speech that the world economy is improving. Indicators and actions – if the market rises and breaks 4865, it is likely a bull market and longs should be the options up to at least 5100.

Bearish measured move – this would be indicated by a continued dropping trend (i.e. breaking below the 4650 support). Should this occur, it indicates the bears have won out and we can expect falls to the proximity of 4000. Should be looking at short sales. This theory is backed by the Chinese market speculation.

Now I have used BHP as I noticed they have a trend of following tech analysis.

BHP

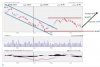

Hoping for a double or triple bottom reversal (below example). At the moment the share had an initial fall from a high of 39.34 to a first decline to 30.58 (representing 22.3%). The share then Retraced to 35.45 (representing a return of 56% of initial loss). It is currently trading around 32. The volumes indicate this could be either a measured move – bearish or a double or triple bottom reversal. Note that I think we can see examples of a number of patterns in this chart such as a head and shoulders top reversal in May, and a head and shoulders bottom reversal before that in April. The prospective options I have identified are detailed below.

Above is an example of the double bottom reversal (thanks to http://www.http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns)

Options

Above is my assessment (excuse the word art) of BHP Bearish Measured Move assessment

Options

1. Should the price drop below approximately 30.5, it indicates this is a Bearish measured move continuation and we can expect that BHP will continue in this fashion until around the $25-26 mark around September.

Above is my BHP Double Bottom Reversal assessment

2. Should the price break the resistance level in the chart below, we are looking at potentially a double or triple bottom reversal. We should wait for it to break the peak of 35.5 and check that volumes have remained relatively steady since the second trough before buying in with the ambition of reaching $40 and this aligns with analyst predictions pre-bernanke speech. This should be the sell point representing an investment return of 14% and should be achieved approximately towards the end July to mid August.

So I am keen to hear any feedback on whether I am going in the right direction regarding technical analysis or not?

Thoughts?

Also, does anyone know of any good online systems that allows simple chart analysis (that aren't $$$$).

Cheers

In the past I have invested based purely on the business reports etc and recommendations on my shareholder site. This has yielded approximately 0% return over the past few years. So, over the past week or so while I have had time off work recovering from an operation, I decided to investigate other options and teach myself a bit about technical analysis. So I have put together some analysis that I conducted based on what I have taught myself and amy looking for feedback, particularly by skilled people but also by others that are just getting into tech analysis. I don't have a fancy trading platform for good analysis so please excuse the word art in this thread.

So I believe it is important to appreciate the macro environment before assessing individual shares. So first up is an assessment on the direction of XAO:

Macro climate

Using the XJO as the index to conduct the assessment.

After reaching a high in mid-May of 5,250 the ASX retreated to a low around 4,650 (representing a drop of 14%) in early/mid June. It rallied to a high a few days later of 4861 (gaining back 33% of its losses). It has again retreated to a low of 4683 (after the Ben Bernanke speech on QE). Some assessments “identified” a short run rising wedge prior to 21 Jun a predicting a long march down. However, the market on 21 Jun doesn’t indicate that the bears are strong enough (I say this based on the initial knee-jerk reaction to very quickly reconsolidate). Macro options assessed as:

Double bottom reversal – this would be indicated by a break above 4860 indicating the bulls have won out and the market is on the rise again. This is supported by pre-Bernanke speech that the world economy is improving. Indicators and actions – if the market rises and breaks 4865, it is likely a bull market and longs should be the options up to at least 5100.

Bearish measured move – this would be indicated by a continued dropping trend (i.e. breaking below the 4650 support). Should this occur, it indicates the bears have won out and we can expect falls to the proximity of 4000. Should be looking at short sales. This theory is backed by the Chinese market speculation.

Now I have used BHP as I noticed they have a trend of following tech analysis.

BHP

Hoping for a double or triple bottom reversal (below example). At the moment the share had an initial fall from a high of 39.34 to a first decline to 30.58 (representing 22.3%). The share then Retraced to 35.45 (representing a return of 56% of initial loss). It is currently trading around 32. The volumes indicate this could be either a measured move – bearish or a double or triple bottom reversal. Note that I think we can see examples of a number of patterns in this chart such as a head and shoulders top reversal in May, and a head and shoulders bottom reversal before that in April. The prospective options I have identified are detailed below.

Above is an example of the double bottom reversal (thanks to http://www.http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns)

Options

Above is my assessment (excuse the word art) of BHP Bearish Measured Move assessment

Options

1. Should the price drop below approximately 30.5, it indicates this is a Bearish measured move continuation and we can expect that BHP will continue in this fashion until around the $25-26 mark around September.

Above is my BHP Double Bottom Reversal assessment

2. Should the price break the resistance level in the chart below, we are looking at potentially a double or triple bottom reversal. We should wait for it to break the peak of 35.5 and check that volumes have remained relatively steady since the second trough before buying in with the ambition of reaching $40 and this aligns with analyst predictions pre-bernanke speech. This should be the sell point representing an investment return of 14% and should be achieved approximately towards the end July to mid August.

So I am keen to hear any feedback on whether I am going in the right direction regarding technical analysis or not?

Thoughts?

Also, does anyone know of any good online systems that allows simple chart analysis (that aren't $$$$).

Cheers