So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

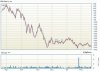

STW – SPDR ASX 200 Fund – Index tracking fund.

Company Summary

I figure its a good time to look at this index tracking fund....this fund trades just like

any stock....u buy and sell through your normal stock broker and can use conditional

orders etc.

The Share price is not as volatile as many other high volume stocks and typically trades

in a smaller range, as would be expected from a true index tracking fund. I would think

trading in this fund is a great way to trade with a high degree of safety as your never

exposed totally to disasters that impact individual company's or sectors...however your

also not 100% exposed to the upside of any commodity or sector move, like the current

Gold rush etc.

Anyway have a read

http://www.spdrs.com.au/library/aus...ong_Term_InvestmentCCRI1228829844.pdf?dtype=2

http://www.spdrs.com.au/etf/fund/fund_detail_STW.html

Interesting to see that STW held 15624 BHP shares on 20/11/08 with the BHP SP at around

$22, and how hold 14668 BHP shares with BHP's SP at $31.50...so sold as the SP went up.

Company Summary

- Security type: EXCHANGE TRADED FUND UNITS (7)

- Market Cap: 949,725,630

- Issued Shares: 30,350,351

- First listed: 27 Aug 2001

- 52-wk High: 58.4700

- 52-wk Low: 30.8700

- Div Yield: 10% + (approx)

- Full & interim dividends partly franked

- Dividend Reinvestment Plan

I figure its a good time to look at this index tracking fund....this fund trades just like

any stock....u buy and sell through your normal stock broker and can use conditional

orders etc.

The Share price is not as volatile as many other high volume stocks and typically trades

in a smaller range, as would be expected from a true index tracking fund. I would think

trading in this fund is a great way to trade with a high degree of safety as your never

exposed totally to disasters that impact individual company's or sectors...however your

also not 100% exposed to the upside of any commodity or sector move, like the current

Gold rush etc.

Anyway have a read

http://www.spdrs.com.au/library/aus...ong_Term_InvestmentCCRI1228829844.pdf?dtype=2

http://www.spdrs.com.au/etf/fund/fund_detail_STW.html

Interesting to see that STW held 15624 BHP shares on 20/11/08 with the BHP SP at around

$22, and how hold 14668 BHP shares with BHP's SP at $31.50...so sold as the SP went up.

In this environment nothing is safe even with government guarantees etc, was watching CNBC when in Asia last week and one analyst was raising the prospect of maybe a sovereign bank going belly up

In this environment nothing is safe even with government guarantees etc, was watching CNBC when in Asia last week and one analyst was raising the prospect of maybe a sovereign bank going belly up