- Joined

- 10 August 2006

- Posts

- 116

- Reactions

- 0

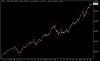

Stuffing around with some figures. Basically for each of the four correction periods (see graph) I dug up the rate of change %ages for stocks. What I wanted to do was compare which ones held up (& consistently) during corrective periods. No suprise, banks & real estate investment trusts at the top of the list, and mining taking the brunt of corrections. With this I hope to find some nice 'boring' stocks for long term, and also see where I stand roughly with speculative stuff in the event of a drop. ie, how volatile are my holdings.

I'm new to trading (1yr odd) - What was suprising was comparing the most recent correction (hmmm, are any of the 4 I have listed really corrections, ie they're all less than 10% drops?) to the duration of the other 3..... People who have come onboard like myself haven't seen what a correction really is, and how long they can go for.

I'm new to trading (1yr odd) - What was suprising was comparing the most recent correction (hmmm, are any of the 4 I have listed really corrections, ie they're all less than 10% drops?) to the duration of the other 3..... People who have come onboard like myself haven't seen what a correction really is, and how long they can go for.