Hi guys,

Some of you might have seen my thread in the forex section called trading chaos, I am going to start a new thread here for index trading, but via a much simpler technique (which the other thread encapsulates but does not rely on).

Please note during this thread I might refer to a buy or sell signal and not elucidate the opposite it is up to you to connect the very big dots together and figure the opposite out.

There will be no squiggly lines on the chart, except possibly for bollinger/stddev/atr bands to determine good TP levels. It is important to stress, we will be reading the PA directly. We are not interested in the trend (although this should be obvious to you: higher highs and higher lows make an uptrend, no moving average required to point that out!). We are interested in taking N number of ticks from the market for ourselves every day and walking away from the screen.

My inspiration for this thread is from a forex trader called feb, we are essentially using his technique which is a very old and common trader technique: fractal breakouts.

A fractal is a simple formation of PA (price action). That is, a buy fractal is generated by a 5 bar pattern of two lower highs, a higher high, followed by two lower highs. Here are two examples:

Sell fractal

Buy fractal

So you can see from above that a "buy fractal" is formed on the close of the 4th bar, as long as the close price remains below the high on the 5th price. The idea of fractal formation is to place a buy order 1 tick above the high of a buy fractal. So when the price breaks that high, you are first in line to see some action.

Now you might be saying to yourself, these formations occur all the time (and they do) how do you pick which one to trade the breakout of?

Well that is the next component in this extremely simple system: we wait for a swing. It depends a lot on the market as to what defines a swing, but generally it is the distance the price will move before other traders start to take profit or it runs into resistance or whatever. For example, the average swing for EURUSD is 30-40 ticks. I believe 30 ticks is a swing on the DAX. We don't mind if the swing is a little bit more or less than that, but if it is significantly less (no strong move) or significantly more (the move is too strong) then we can stay out of that swing.

Here is a swing and following fractal:

So you can see what the gist of the system is already. We wait for the price to move, and we make sure the movement is a solid one (swing). Then we wait for the price to pull back. During the pull back, we place a buy order one tick above the high of the fractal. This means that if the swing resumes its previous direction, then we are first in line testing the market to see if it will go higher.

Hopefully it all makes sense so far. If you feel lost, all the stuff I've covered is common floor trader knowledge and posted all over the internet. You can read up on it further before continuing.

Now we know which fractals we are interested (those at the edge of a swing) we will add one more simple tool to determine whether we want to be first in line to test the market, or leave it be.

This simple tool, many of you already know, it is the fibonacci lines. We are not interested in the fib levels specifically (except for 50%) but just because they give us a % idea of the pullback. So using what we know now:

1. Wait for a swing.

2. Price pulls back, fractal forms, we place our order above or below the fractal

3. Draw a fibonacci on the swing.

The fibonacci lines immediately provide us with information. We know the range of the swing, we know the halfway point of the swing, and we can roughly delineate (using 38 and 61 fib lines) where the 33 and 66% of the swing is.

Here is an example from todays market (I will not name the instrument, it is irrelevant):

Just from following the above steps using this example we can see we would already be interested in testing the market if it goes below the 0% line. But we must be patient and watch, with our order ready to go. If the pullback of the swing is more than 50% then it might be the start of a new swing and we best not test the market even if it goes below the 0% line later.

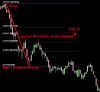

Here is an example of what I mean:

You can see in this case, after the swing, the price managed to retrace and close above 50% of the swing. So we are not interested in testing the market if it goes below the 0 line, we just wait for the next setup!

Some of you might have seen my thread in the forex section called trading chaos, I am going to start a new thread here for index trading, but via a much simpler technique (which the other thread encapsulates but does not rely on).

Please note during this thread I might refer to a buy or sell signal and not elucidate the opposite it is up to you to connect the very big dots together and figure the opposite out.

There will be no squiggly lines on the chart, except possibly for bollinger/stddev/atr bands to determine good TP levels. It is important to stress, we will be reading the PA directly. We are not interested in the trend (although this should be obvious to you: higher highs and higher lows make an uptrend, no moving average required to point that out!). We are interested in taking N number of ticks from the market for ourselves every day and walking away from the screen.

My inspiration for this thread is from a forex trader called feb, we are essentially using his technique which is a very old and common trader technique: fractal breakouts.

A fractal is a simple formation of PA (price action). That is, a buy fractal is generated by a 5 bar pattern of two lower highs, a higher high, followed by two lower highs. Here are two examples:

Sell fractal

Buy fractal

So you can see from above that a "buy fractal" is formed on the close of the 4th bar, as long as the close price remains below the high on the 5th price. The idea of fractal formation is to place a buy order 1 tick above the high of a buy fractal. So when the price breaks that high, you are first in line to see some action.

Now you might be saying to yourself, these formations occur all the time (and they do) how do you pick which one to trade the breakout of?

Well that is the next component in this extremely simple system: we wait for a swing. It depends a lot on the market as to what defines a swing, but generally it is the distance the price will move before other traders start to take profit or it runs into resistance or whatever. For example, the average swing for EURUSD is 30-40 ticks. I believe 30 ticks is a swing on the DAX. We don't mind if the swing is a little bit more or less than that, but if it is significantly less (no strong move) or significantly more (the move is too strong) then we can stay out of that swing.

Here is a swing and following fractal:

So you can see what the gist of the system is already. We wait for the price to move, and we make sure the movement is a solid one (swing). Then we wait for the price to pull back. During the pull back, we place a buy order one tick above the high of the fractal. This means that if the swing resumes its previous direction, then we are first in line testing the market to see if it will go higher.

Hopefully it all makes sense so far. If you feel lost, all the stuff I've covered is common floor trader knowledge and posted all over the internet. You can read up on it further before continuing.

Now we know which fractals we are interested (those at the edge of a swing) we will add one more simple tool to determine whether we want to be first in line to test the market, or leave it be.

This simple tool, many of you already know, it is the fibonacci lines. We are not interested in the fib levels specifically (except for 50%) but just because they give us a % idea of the pullback. So using what we know now:

1. Wait for a swing.

2. Price pulls back, fractal forms, we place our order above or below the fractal

3. Draw a fibonacci on the swing.

The fibonacci lines immediately provide us with information. We know the range of the swing, we know the halfway point of the swing, and we can roughly delineate (using 38 and 61 fib lines) where the 33 and 66% of the swing is.

Here is an example from todays market (I will not name the instrument, it is irrelevant):

Just from following the above steps using this example we can see we would already be interested in testing the market if it goes below the 0% line. But we must be patient and watch, with our order ready to go. If the pullback of the swing is more than 50% then it might be the start of a new swing and we best not test the market even if it goes below the 0% line later.

Here is an example of what I mean:

You can see in this case, after the swing, the price managed to retrace and close above 50% of the swing. So we are not interested in testing the market if it goes below the 0 line, we just wait for the next setup!