Zaxon

The voice of reason

- Joined

- 5 August 2011

- Posts

- 800

- Reactions

- 881

I'd like to summarize the ways of making money on individual shares during price declines. In the perfect world, it would be like a stock: can hold indefinitely; costs you nothing to hold it; can buy small and medium caps. I'm presuming no such thing exists for shorting, but as close to my wish list as possible.

Options I know of are:

I'd like for you guys who preferably have a good knowledge of these options, to rank them on the following criteria.

Scenario: You have $10k to short a stock. You want the option to hold that short for a year. You can easily buy in or sell at any time, so good liquidity. Ideally, you have the option of shorting a medium (or small cap), but I understand I mighn't get that wish. You're not wanting to leverage this any more than you have to. This isn't a hedge against an existing stock.

What I'd like to know is:

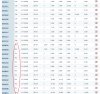

Options I know of are:

- Directly shorting the stock

- Shorting CFDs of the stock

- Shorting Futures of the stock

- Buying Put Options

I'd like for you guys who preferably have a good knowledge of these options, to rank them on the following criteria.

Scenario: You have $10k to short a stock. You want the option to hold that short for a year. You can easily buy in or sell at any time, so good liquidity. Ideally, you have the option of shorting a medium (or small cap), but I understand I mighn't get that wish. You're not wanting to leverage this any more than you have to. This isn't a hedge against an existing stock.

What I'd like to know is:

- Which of the methods above allows this or comes closest?

- Which methods are the lowest cost? What would the approximate cost be for each method?

- Which methods are the safest: low counterparty risk, broker not artificially manipulating the market (eg: CFDs)

- Which methods are safer by limiting the amount of money you could lose if the stock goes up in price? (For instance, buying puts you only risk your initial fee.)

- Relative ease of use for someone new to the instrument. As much as possible, your existing knowledge of how to invest in shares should be relevant to this security

- Liquidity. How easy is to get in and out of these positions?

- What "universe of shares" does each method give me? Am I limited to just the 86 stocks that broker has chosen?

- Can I short small caps with this method?

- Directly shorting the stock requires you to pay any owed dividend, so mightn't be a good idea for a long term hold

- Puts and Futures have expiry dates.

- Puts are relatively safe, since the most you can lose is the down payment.

- Options market doesn't have good liquidity in Australia

- I've heard all good derivative traders eventually move to futures. I don't know if this is true.

- CFDs seem to have a lot of on going borrowing fees.

- With stock shorting, you're limited to the actual shares the broker has access to