Hello everyone, I'm Steve been a member on here for many years and I just read things and never say anything.

I have a little issue and want to ask some advice.

Years ago I got caught up in the Hydrogen hype and bought some PRL shares and they have not done very well.

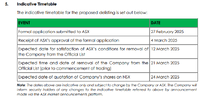

These shares have been in suspension for around 2 years, the last announcement says they will be delisting from ASX and proposed listing on NSX listing.

How would I go about getting rid of these shares? I can't find any info on joining the NSX and creating an account.

Any help would be fantastic and thank you. Steve.

I have a little issue and want to ask some advice.

Years ago I got caught up in the Hydrogen hype and bought some PRL shares and they have not done very well.

These shares have been in suspension for around 2 years, the last announcement says they will be delisting from ASX and proposed listing on NSX listing.

How would I go about getting rid of these shares? I can't find any info on joining the NSX and creating an account.

Any help would be fantastic and thank you. Steve.