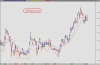

SAR is up 21% today on no news. The Neison SMA shows strong after market buying pressure over the last week, and today's candle was propelled by one moderately large order going through. Does anyone know anything about these guys?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SAR - Saracen Mineral Holdings

- Thread starter moses

- Start date

- Joined

- 26 October 2006

- Posts

- 327

- Reactions

- 0

Re: SAR - Saracen Mineral

I just received this via email from ShareCafe:

Saracen - A Really Big Gold Nugget?

THE CAFE TAKE - 24/08/2007

If you believe in gold then here's an interesting little company. It owns the most modern gold mill in the country. The mill sits in the middle of 2 million ounces of gold resources that it owns and is surrounded by Barrack, Newmont, Anglo Gold and Newcrest all looking for gold.

The CEO has put $9,000,000 into the company and owns over 20%. It's capped at just over $40 million even though the mill alone is worth at least $30 million alone in a fire sale.

It has $16.2 million in cash. It estimates its cash cost to get the gold out of the ground is AU $500 - $575. What's the company - Saracen Mineral Holdings Ltd (ASX:SAR).

Guido Staltari, CEO, has 4.5 million tonnes of ore and wants to add another 4.5 million. He is exploring in highly prospective areas around the mill.

There are many other explorers in this area looking for gold and they would use the mill if they found reserves. If one of the majors found gold in this famous gold area, than they could easily buy Saracen or use it to mill their ore.

Click here to download a detailed report from respected broker Aequs Securities. (this is 2.66 MB so can't attach!)

They have a valuation of $0.75 cents vs around $0.30 cents currently. We think it's interesting when the CEO has put his money where his mouth is, and the company has 2 million ounces of gold resources, an excellent mill, and is highly leveraged to any increase in the gold price.

Anyone done any independant fundamentals on this?

I just received this via email from ShareCafe:

Saracen - A Really Big Gold Nugget?

THE CAFE TAKE - 24/08/2007

If you believe in gold then here's an interesting little company. It owns the most modern gold mill in the country. The mill sits in the middle of 2 million ounces of gold resources that it owns and is surrounded by Barrack, Newmont, Anglo Gold and Newcrest all looking for gold.

The CEO has put $9,000,000 into the company and owns over 20%. It's capped at just over $40 million even though the mill alone is worth at least $30 million alone in a fire sale.

It has $16.2 million in cash. It estimates its cash cost to get the gold out of the ground is AU $500 - $575. What's the company - Saracen Mineral Holdings Ltd (ASX:SAR).

Guido Staltari, CEO, has 4.5 million tonnes of ore and wants to add another 4.5 million. He is exploring in highly prospective areas around the mill.

There are many other explorers in this area looking for gold and they would use the mill if they found reserves. If one of the majors found gold in this famous gold area, than they could easily buy Saracen or use it to mill their ore.

Click here to download a detailed report from respected broker Aequs Securities. (this is 2.66 MB so can't attach!)

They have a valuation of $0.75 cents vs around $0.30 cents currently. We think it's interesting when the CEO has put his money where his mouth is, and the company has 2 million ounces of gold resources, an excellent mill, and is highly leveraged to any increase in the gold price.

Anyone done any independant fundamentals on this?

- Joined

- 26 October 2006

- Posts

- 327

- Reactions

- 0

- Joined

- 3 July 2007

- Posts

- 153

- Reactions

- 0

This has gone up more than 50% for me since I bought it. I am quite surprised that this stock doesn't get the attention she deserves. I think there is still quite a bit to go, as a comparison with MON

MON - Market cap 137M, 2.4M ounces, 2 plants total capacity of 1.8MT pa.

SAR - Market cap 65M, >2M ounces (not all economical), 1 plant capacity of 2.4MT pa.

SAR's tenements are mostly together while MON's are a bit spread out. Overall grades for both are pretty low at around 2g/t. I don't know about MON's plants but SAR's plants are quite economical on low grades.

I don't know much about MON so I might be a bit off here please correct me if I made mistake(s).

Happy trading/investing.

MON - Market cap 137M, 2.4M ounces, 2 plants total capacity of 1.8MT pa.

SAR - Market cap 65M, >2M ounces (not all economical), 1 plant capacity of 2.4MT pa.

SAR's tenements are mostly together while MON's are a bit spread out. Overall grades for both are pretty low at around 2g/t. I don't know about MON's plants but SAR's plants are quite economical on low grades.

I don't know much about MON so I might be a bit off here please correct me if I made mistake(s).

Happy trading/investing.

- Joined

- 1 November 2006

- Posts

- 373

- Reactions

- 14

I'd not noticed Saracen, but this new announcement might raise their profile:

The Directors advise that the Company has requested the Australian Securities Exchange (ASX) to grant a halt on the trading of the Company’s securities prior to the commencement of trading today.

The trading halt was requested pending the outcome of a placement of ordinary shares in Saracen (Placement) to institutional/sophisticated investors. The trading halt is requested until the earlier of the outcome of the Placement is announced to the ASX and the commencement of trading on Monday 22 June 2009.

The Company expects to raise no less than A$20 million from this placement. The Directors are also pleased to advise that Straits Resources Limited has agreed to subscribe for approximately A$3 million worth of ordinary shares, or approximately 5 percent of the Company’s post-placement issued capital.

The Directors advise that the Company has requested the Australian Securities Exchange (ASX) to grant a halt on the trading of the Company’s securities prior to the commencement of trading today.

The trading halt was requested pending the outcome of a placement of ordinary shares in Saracen (Placement) to institutional/sophisticated investors. The trading halt is requested until the earlier of the outcome of the Placement is announced to the ASX and the commencement of trading on Monday 22 June 2009.

The Company expects to raise no less than A$20 million from this placement. The Directors are also pleased to advise that Straits Resources Limited has agreed to subscribe for approximately A$3 million worth of ordinary shares, or approximately 5 percent of the Company’s post-placement issued capital.

SAR- Saracen Minerals Holdings

Just wondering if anyone has an opinion on Saracen Minerals.Got a mention in the September issue of Smart Investor in the Tomorrow's Titans article.

Looks like they are reviving the former Sons of Gwalia Carosue Dam gold operations in WA.Will start production at the beginning of next year and seem to have a lot of cash behind them.

Anyone else with some more info?

Just wondering if anyone has an opinion on Saracen Minerals.Got a mention in the September issue of Smart Investor in the Tomorrow's Titans article.

Looks like they are reviving the former Sons of Gwalia Carosue Dam gold operations in WA.Will start production at the beginning of next year and seem to have a lot of cash behind them.

Anyone else with some more info?

- Joined

- 3 July 2007

- Posts

- 153

- Reactions

- 0

Re: SAR- Saracen Minerals Holdings

I am still holding these. Don't have any info that's not released. Will be moving to Kal early next year so might be able to take a look.

Just wondering if anyone has an opinion on Saracen Minerals.Got a mention in the September issue of Smart Investor in the Tomorrow's Titans article.

Looks like they are reviving the former Sons of Gwalia Carosue Dam gold operations in WA.Will start production at the beginning of next year and seem to have a lot of cash behind them.

Anyone else with some more info?

I am still holding these. Don't have any info that's not released. Will be moving to Kal early next year so might be able to take a look.

- Joined

- 28 March 2006

- Posts

- 3,554

- Reactions

- 1,283

- Joined

- 1 March 2010

- Posts

- 3

- Reactions

- 0

Am eagerly awaiting SP to fall so as to increase our holdings. Day after day, the price keeps going up. Oh well. Patience is a virtue. I won't fall for the trap of buying while the price is on the way up. Today, it closed at 67c.

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 1

A very promising gold producer and explorer.

SAR has a good mix of speculative appeal with their extensive exploration and support through their solid long term production. SAR looks to be in a very good position right now.

http://www.saracen.com.au/download-414.html

Euroz report very complimentary of course, but it seems to stack up.

Retail capital raising to be completed end of next week, plenty of cash, POG holding up. May be a good time to have a look at this stock with the luster of RMS failing recently.

Boggo what is your take on the latest action, seems to be a bit of buying, do you think there will be more of a shakeout before a resumption of a move up due to general market factors and the capital raising at 68c ? It looks like a revisit to 68c level is possible, seems to be an important level - wait for a test ?

SAR has a good mix of speculative appeal with their extensive exploration and support through their solid long term production. SAR looks to be in a very good position right now.

http://www.saracen.com.au/download-414.html

Euroz report very complimentary of course, but it seems to stack up.

Retail capital raising to be completed end of next week, plenty of cash, POG holding up. May be a good time to have a look at this stock with the luster of RMS failing recently.

Boggo what is your take on the latest action, seems to be a bit of buying, do you think there will be more of a shakeout before a resumption of a move up due to general market factors and the capital raising at 68c ? It looks like a revisit to 68c level is possible, seems to be an important level - wait for a test ?

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 1

- Joined

- 27 December 2010

- Posts

- 1,729

- Reactions

- 48

Is anyone following these guys? Big profit posted last year...theres not much in the way of analyst research however...

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 1

Is anyone following these guys? Big profit posted last year...theres not much in the way of analyst research however...

130,000 in FY2012 and the Company has targeted an increase in production to around 250,000 ozpa,

principally through organic growth over the next two or more years.

As at 30 June 2011, Gold Resources stood at around 3.6 million oz while

Reserves stood at around 0.83 million oz.

The Carosue Dam operations area contains a large

number of known gold deposits within two regions,

the Southern and Northern regions. (see Figure).

Current gold production is from open pit mines in

the Southern region (“Southern Operations”).

This will be supplemented by additional open pit

mines, and (subject to positive feasibility study and,

where applicable, trial mining results) underground

operations at Porphyry, Red October, Whirling

Dervish and Deep South.

A development programme at Red October has

commenced, with a view to establishing trial

underground mining operations in the Northern

region (“Northern Operations”).

From the latest quarterly.

SAR have been moving along nicely, however have been missing the excitement factor or spectacular drill results, not to mention they are based in Australia rather than West Africa.

Minor interruptions have resulted in decreased production in the latest quarter, however this is acknowledged by management and increased grades are to be fed through to maintain the 120-130 kOz target for the year. Such great information provided by management, clear, concise and easy to follow.

Technically not very inspiring, in fact a bit of a worry with the 80c support not holding. This may be due to better goldies producing at this time, SAR costs / Oz are high and rising at the moment, which makes their operation more sensitive to POG.

Always watching as SAR are a good operation with plans to move into the 200kOz/annum arena in the next few years, along with RMS, NST.

Further drilling ongoing, but generally extensional in nature it seems at this stage.

Perhaps with the lack of debt and plenty of cash, there should be consideration of either a dividend or some aggressive exploration/acquisitions ?

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 1

Looking like a recovery from the support level at 0.70 and offers a good entry for a decent producer. If POG maintains these levels then SAR will be raking it in. Going well and looking good technically so long as it stays above that level!

Along with several others, these stocks are selling at surprisingly attractive levels. A mid size merger or takeover might fire interest back up. DRM and RMS talk didn't seem to hold much water but that is for another thread.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,225

Inverted H&S. Not me, the stock.

Haha, unfortunately it broke down.

If anyone has been following, why the poor performance recently ? Register is wide open, large production with plenty of drilling and proven room for expansion.

View attachment 48508

Anyone ?

Still on board or never on it Mr Jeff? Like the look of this one...volume picking up with buyers controlling the market up 12% today.

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 1

Still on board or never on it Mr Jeff? Like the look of this one...volume picking up with buyers controlling the market up 12% today.

Yes I have recently entered this stock in a small way and waiting for confirmation before buying more. The way gold is moving, I am looking for strength to show up here even on down days. If it doesn't perform as well as other comparable gold stocks, I will sell again and keep watching.

Never hurt to buy NST, always seems to move well!

Similar threads

- Replies

- 1

- Views

- 4K

- Replies

- 1

- Views

- 3K