- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

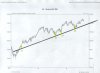

S&P 500 ( Profit Taking ? )

or

is this Panic Selling waiting in the midst ?....

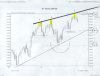

This is a very valuable chart formation...... The 1st chart here shows true support... any more down days in the near future will probably violate it and cause this to look like a breakout in which a whole lot of traders will be interested... that's why I don't trade break-outs.

IT IS TOO LATE WHEN IT BREAKS OUT.....4 ATTEMPTS HAVE BEEN MADE ON THIS LINE.....

THE QUESTION IS WILL THIS HOLD UP?

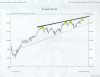

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective. This information is for educational purposes and should not be considered trading recommendations. All trading decisions are your own sole responsibility …

or

is this Panic Selling waiting in the midst ?....

This is a very valuable chart formation...... The 1st chart here shows true support... any more down days in the near future will probably violate it and cause this to look like a breakout in which a whole lot of traders will be interested... that's why I don't trade break-outs.

IT IS TOO LATE WHEN IT BREAKS OUT.....4 ATTEMPTS HAVE BEEN MADE ON THIS LINE.....

THE QUESTION IS WILL THIS HOLD UP?

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective. This information is for educational purposes and should not be considered trading recommendations. All trading decisions are your own sole responsibility …