- Joined

- 13 September 2013

- Posts

- 988

- Reactions

- 530

RealTest is a new portfolio level backtesting tool that has been developed by Market Wizard Marsten Parker. His website can be found here RealTest (mhptrading.com)

There is plenty of info on the site about it features and some tips and tricks, plus a few youtube clips (He's doing more soon).

The software has been released this year and in my opinion blows Amibroker out the water in many aspects, although i still use AB for some strategies. The language is easy to learn and if you have used AB or tradestation it is very quick to pickup.

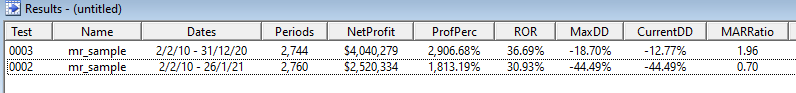

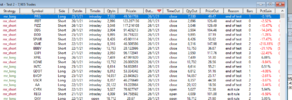

The powerful thing about RealTest (RT) imo is the control you can get over the strategies you build. Its like being proficient at AB CBT (which i'm not) but in just a few lines. Another powerful feature is the ability to test multiple strategies in one script and accurately control how funds are allocated between them, position size, Multiple time frames etc. It can use Norgate Data so tests are accurate, can easily use yahoo data too if you're happy with that or just beginning.

If you trade shorter EOD time frames then i think RT is more powerful than AB, plus MUCH faster. I have been using AB since 2016 and have moved all my short term systems to RT while adding some more.

There's a free trail and it would be good to have some guys check it out and ask some questions, i've been using it for a few months and wont be looking back.

I can post some charts if anyone wants. There's too many features to list straight up!

There is plenty of info on the site about it features and some tips and tricks, plus a few youtube clips (He's doing more soon).

The software has been released this year and in my opinion blows Amibroker out the water in many aspects, although i still use AB for some strategies. The language is easy to learn and if you have used AB or tradestation it is very quick to pickup.

The powerful thing about RealTest (RT) imo is the control you can get over the strategies you build. Its like being proficient at AB CBT (which i'm not) but in just a few lines. Another powerful feature is the ability to test multiple strategies in one script and accurately control how funds are allocated between them, position size, Multiple time frames etc. It can use Norgate Data so tests are accurate, can easily use yahoo data too if you're happy with that or just beginning.

If you trade shorter EOD time frames then i think RT is more powerful than AB, plus MUCH faster. I have been using AB since 2016 and have moved all my short term systems to RT while adding some more.

There's a free trail and it would be good to have some guys check it out and ask some questions, i've been using it for a few months and wont be looking back.

I can post some charts if anyone wants. There's too many features to list straight up!