chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

Guidelines stolen from the potential breakout thread:

Obviously this thread is for any stocks looking likely to break down. I'll go first.

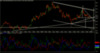

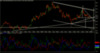

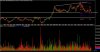

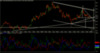

I can't see any reason to be long ERA. Still firmly in an almost year long downtrend, in a market that is showing a tendency to roll over on stocks in established downtrends. Seasonal mining difficulties coming up... in what looks to be a very wet wet season. Just a few reasons to get short... plus, ERA reacts badly to any market correction...

But there is both good and bad news. The good news being that this should only get to it's lower trend line. The bad news is, that trend line will be between 10 and 11 dollars if/ when it gets there.

A couple of T/A observations. I'm assuming we are in a corrective c of some sort. A symmetrical C should see this get to about 10.80. We also have quite an obvious and symmetrical H&S pattern just about complete. The breakdown target from that is in the low 12's. Another interesting thing, is that this has had almost no buying interest on dips. Volume just stays flat. Virtually no interest on up days of late either. All this points to a high probability of seeing ERA between about $12 and $11.

With the chance of a very good R:R trade on it.

Cheers.

The following are absolutely mandatory:

1) A chart. If there is no chart attached the post will be removed.

2) A few sentences explaining your analysis, including details of any relevant support and resistance points.

Obviously this thread is for any stocks looking likely to break down. I'll go first.

I can't see any reason to be long ERA. Still firmly in an almost year long downtrend, in a market that is showing a tendency to roll over on stocks in established downtrends. Seasonal mining difficulties coming up... in what looks to be a very wet wet season. Just a few reasons to get short... plus, ERA reacts badly to any market correction...

But there is both good and bad news. The good news being that this should only get to it's lower trend line. The bad news is, that trend line will be between 10 and 11 dollars if/ when it gets there.

A couple of T/A observations. I'm assuming we are in a corrective c of some sort. A symmetrical C should see this get to about 10.80. We also have quite an obvious and symmetrical H&S pattern just about complete. The breakdown target from that is in the low 12's. Another interesting thing, is that this has had almost no buying interest on dips. Volume just stays flat. Virtually no interest on up days of late either. All this points to a high probability of seeing ERA between about $12 and $11.

With the chance of a very good R:R trade on it.

Cheers.