Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 204

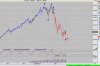

Have a look at this. With bank and other financials imploding all over Europe and the US guess what is happening in the little Aussie market. The Banks (and other fins) are showing the first signs of positive divergence. They have been going pretty much nowhere since March. Up a bit then back down a bit and really just flat lined it since July. Now as the XJO/XAO makes lows not seen since November 05 the XXJ (fin sector ex property) & XFJ (with property) has fallen to late 05 levels at the start of the year and stuck. Something to keep an eye on

This is the Financials-ex-property (Candles) compared to the XJO(Red line)

This is the Financials-ex-property (Candles) compared to the XJO(Red line)