- Joined

- 9 May 2009

- Posts

- 118

- Reactions

- 2

Price gaps can potentially provide new information for traders including points of entry, exits, stop loss, support areas, and resistance. Plus, always important protecting profits

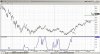

Taking a look at the exchange traded note (ETN) Symbol:INP which looks to track India's market, notice the gap up in price recently. While INP is still rated as bullish on the Tradesurfer Indicator and the uptrend is still in place, some technicians may use this new price information to move their exit or stops up now that the market has given us a new support area. Generally, when there is a gap up, once price settles it establishes a floor or support line. This very area now provides us with a line in the sand and a place where we might place a stop. Now rather than placing a stop loss market order right on the line, better to put it a little below so only if price violates support does the market sell execute. This way there is enough breathing room. Why not use $46 which is where the line sits? Simply put, a support area will quite often see price fall to it before bouncing off and back up if it does its job correctly.

So if price does violate the $46 level then what? There is the general thinking among technicians that once price re-enters the gap area it tends to "fill that gap" and would re-test the $40 level in this case which would be the next support area.

Those looking for a potential short might wait and short only if price breaks back down and closes below $46 with a downside target objective of around $40. While the initial long indication came at $30 on our indicator, this may potentially be a technique to protect profits. Remember, even if price retraces only to then move back, you can always rejoin the trend.

My goal is to provide FREE trading education. Feedback always encouraged.

Chart follows on next post.

Taking a look at the exchange traded note (ETN) Symbol:INP which looks to track India's market, notice the gap up in price recently. While INP is still rated as bullish on the Tradesurfer Indicator and the uptrend is still in place, some technicians may use this new price information to move their exit or stops up now that the market has given us a new support area. Generally, when there is a gap up, once price settles it establishes a floor or support line. This very area now provides us with a line in the sand and a place where we might place a stop. Now rather than placing a stop loss market order right on the line, better to put it a little below so only if price violates support does the market sell execute. This way there is enough breathing room. Why not use $46 which is where the line sits? Simply put, a support area will quite often see price fall to it before bouncing off and back up if it does its job correctly.

So if price does violate the $46 level then what? There is the general thinking among technicians that once price re-enters the gap area it tends to "fill that gap" and would re-test the $40 level in this case which would be the next support area.

Those looking for a potential short might wait and short only if price breaks back down and closes below $46 with a downside target objective of around $40. While the initial long indication came at $30 on our indicator, this may potentially be a technique to protect profits. Remember, even if price retraces only to then move back, you can always rejoin the trend.

My goal is to provide FREE trading education. Feedback always encouraged.

Chart follows on next post.