- Joined

- 24 November 2005

- Posts

- 15

- Reactions

- 0

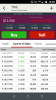

What are those massive volume spikes between 4PM Friday and 10AM Monday in Commsec?

The majority of shares traded take place in normal trading hours.Any clues as to why these outside market hours trading sessions make market time volume practically irrelevant? It seems like no one trades between 10 and 4. After 4 everyone puts in their orders?

But if they are high volume spikes, suggesting institutional activity, then it would still be important to use the closing prices on daily charts when drawing lines.The majority of shares traded take place in normal trading hours.

Some stocks, usually it's the smaller speculative stocks, that do what you have suggested though.

This means price movements are generally happening at auction close/ open.

Gap ups, downs occur on open and close frequently.

Read up on the DOM, depth of market.

BUD and RXL are examples where this style of trade frequently occurs.

F.Rock

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.