- Joined

- 6 November 2005

- Posts

- 915

- Reactions

- 0

Hi folks,

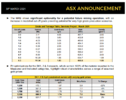

OKU ... listing noon 16052007 and astroanalysis suggests this will be

yet another IPO to watch from the sidelines, until mid-June 2007,

when the next positive time cycle is due to come into play:

16052007 ..... lists with two fading, but difficult cycles in force.

24052007 ..... significant and negative news/move expected here.

30052007 ..... another difficult cycle here ... finance-related ???

14062007 ..... negative spotlight on OKU ... looking for a low here?

15-18062007 ..... test of low early and then an aggressive rally ???

02-03072007 ..... significant positive cycle ... finance-related ... and

an underlying positive theme from 09-16072007

16072007 ..... a difficult cycle here

27-30072007 ..... another difficult cycle here

01082007 ..... difficult news expected here

16-17082007 ..... two significant and positive time cycles here,

should finally bring some good news ... !~!

20-21082007 ..... minor but positive cycle ... finances???

03092007 ..... negative news expected here

happy days

paul

=====