- Joined

- 13 February 2006

- Posts

- 4,945

- Reactions

- 10,984

The People's Bank of China (PBoC) has announced monetary stimulus that includes cutting the reserve requirement ratio (RRR) by 0.5 percentage points. It also plans to implement further interest rate reductions and inject approximately 1 trillion yuan of long-term liquidity into the economy. This move has helped alleviate concerns about economic activity, as indicated by discrepancies between the NBS and Caixin PMIs and deteriorations in several official PMI components shown in the table.

Crypto:

Volatility is down, way down.

The correlation with NASDAQ is waning, at least currently. Why?

The Savage 7 are stalling. Equal weight in ascendance. Why?

Mr FFF

Insane China Squeeze Underway

Mon Sep 30, 2024 10:22am EST 0

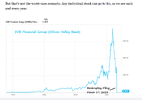

Last night the Asian markets took on a ribald quality, with the NIKKEI capsizing more than 4.9% due to their new Prime Minister and looming rate hikes, which in turn will unwind the Yen carry trade and China shooting higher by 8%, based off this notion that the government will actively intervene in markets to boost share prices. We heard people like David Tepper declare “buy everything” in China last week in response to this news.

The subsequent results have been nothing less than staggering, with Chicoms ripping 30 to 40% the past 2 weeks.

The double leveraged $CWEB ETF is +89% in the past two weeks.

Clearly, this is overdone to the upside; but now China bulls are pointing to the very large short positions in these stocks and wanting more. Bear in mind, like the oils and basic materials, the China bull trade has been dormant for a very long time, which was a convenient hedge for long short funds to constantly bet against. Now with the fervor pointing straight up, we have ourselves a classic short squeeze playing out and once these things get started, it’s really hard to predict when they’ll end: case in point $GME.

As we stand currently

The thesis:

China's stimulus will attract money out of the US back to China. If it's a significant repatriation, we will have issues in the US.

jog on

duc