- Joined

- 28 May 2004

- Posts

- 10,833

- Reactions

- 5,173

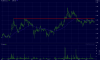

Neon Energy (NEN) was previously known as Salinas Energy (SAE).

For discussion of this company when it was known as Salinas Energy please refer to the SAE thread, which can be found here: https://www.aussiestockforums.com/forums/showthread.php?t=6630

For discussion of this company when it was known as Salinas Energy please refer to the SAE thread, which can be found here: https://www.aussiestockforums.com/forums/showthread.php?t=6630