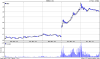

I liked the look of RMBS's chart on Wed 15th - it looked like it had made a strong line of support at 16 and looked like it was going up to 19.60-20. So, I bought some at 17.13 (almost the high of the day, doh!). Then on Thursday morning as it approached 20 and pulled back a bit I though that it may be making a short-term top as expected. Rather than jump ship like I normally would after getting a nice profit I instead sold a Jan 20 call for 1.75 then I was done for the day (night for me). The stock finished up 30% near 22 so now I have an obligation to deliver at 20 in Jan if I don't close out before then.

Bought stock at 17.13

Sold Jan 20 Call for 1.75

Last price for stock 21.72

If it finishes over 20 at exp I'll have a 2.87 profit on the stock and 1.75 for the sold call, that is a 4.62 profit.

I'm writing this to ask what you would have done differently and what you might consider doing with this trade now.

As my first options trade it feels a little bitter having sold a call that immediately went ITM by almost 2 points! But on the other hand I doubt I would have held on otherwise and I would be anyway.

anyway.

Any comments? What have I gotten myself into?

Bought stock at 17.13

Sold Jan 20 Call for 1.75

Last price for stock 21.72

If it finishes over 20 at exp I'll have a 2.87 profit on the stock and 1.75 for the sold call, that is a 4.62 profit.

I'm writing this to ask what you would have done differently and what you might consider doing with this trade now.

As my first options trade it feels a little bitter having sold a call that immediately went ITM by almost 2 points! But on the other hand I doubt I would have held on otherwise and I would be

Any comments? What have I gotten myself into?