- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Hi everyone,

Time for a new investment thread!

Those who followed my previous investment journey know that I always had a lean towards automated strategies. That interest eventually took me to start a new technology business, which I will now be using to invest my super portfolio.

I will start off with $50,000 and 4% position size. I have chosen a strategy based on Piotroski F score. This is a modified version of it, however, the underlying economic rationale remains the same.

The score is named after Stanford accounting professor, Joseph Piotroski. He showed that by analysing neglected stocks, as defined by having very low price to book ratios, and using a nine-point accounting-based ‘health’ score, you could significantly outperform the market.

Where my strategy differs from his is that I have included yearly price change as a ranked factor. This means that I’ll be investing in companies which have had the lowest price to book and highest yearly price change. In other words, I’m looking to invest in undervalued healthy companies which are trending up and have potentially turned the corner over the preceding year.

Companies I’ll be investing in must be classified as strong (i.e. 8 and above) which means I know that they are profitable, have increasing margins, they can pass an accounting trick test, and have an improving balance sheet. If a company I have invested in falls in to the ‘weak’ category, I’ll sell it.

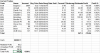

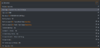

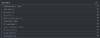

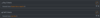

Here are some screenshots of the setup:

I’ll invest in Australia only. I’ve excluded Foreign and OTC stocks, as well as Metals and Mining industry. I’ve set minimum Market Cap to $50m and minimum share price to $0.30. I’ve sorted companies using a combined score of Price to Book ratio and Yearly Price change.

Portfolio options - $50,000 start, 4% position size, $20 brokerage. I am not factoring in interest on undeployed cash at this point and I am assuming slippage costs of 0.5%. I will set Maximum Trades Per Step to 3, so that capital is deployed over time.

Very simple buy and sell criteria – buy when the score is over 8 and sell when it falls under 5.

I will sell losers after a year. I will also sell 80% of a holding if it has gone up in price 400%.

Time for a new investment thread!

Those who followed my previous investment journey know that I always had a lean towards automated strategies. That interest eventually took me to start a new technology business, which I will now be using to invest my super portfolio.

I will start off with $50,000 and 4% position size. I have chosen a strategy based on Piotroski F score. This is a modified version of it, however, the underlying economic rationale remains the same.

The score is named after Stanford accounting professor, Joseph Piotroski. He showed that by analysing neglected stocks, as defined by having very low price to book ratios, and using a nine-point accounting-based ‘health’ score, you could significantly outperform the market.

Where my strategy differs from his is that I have included yearly price change as a ranked factor. This means that I’ll be investing in companies which have had the lowest price to book and highest yearly price change. In other words, I’m looking to invest in undervalued healthy companies which are trending up and have potentially turned the corner over the preceding year.

Companies I’ll be investing in must be classified as strong (i.e. 8 and above) which means I know that they are profitable, have increasing margins, they can pass an accounting trick test, and have an improving balance sheet. If a company I have invested in falls in to the ‘weak’ category, I’ll sell it.

Here are some screenshots of the setup:

I’ll invest in Australia only. I’ve excluded Foreign and OTC stocks, as well as Metals and Mining industry. I’ve set minimum Market Cap to $50m and minimum share price to $0.30. I’ve sorted companies using a combined score of Price to Book ratio and Yearly Price change.

Portfolio options - $50,000 start, 4% position size, $20 brokerage. I am not factoring in interest on undeployed cash at this point and I am assuming slippage costs of 0.5%. I will set Maximum Trades Per Step to 3, so that capital is deployed over time.

Very simple buy and sell criteria – buy when the score is over 8 and sell when it falls under 5.

I will sell losers after a year. I will also sell 80% of a holding if it has gone up in price 400%.