- Joined

- 27 June 2010

- Posts

- 4,147

- Reactions

- 309

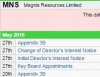

On September 25th, 2014, Uranex Limited (UNX) changed its name and ASX code to Magnis Resources Limited (MNS).

Previous discussion of Uranex Limited can be found in the UNX thread: https://www.aussiestockforums.com/forums/showthread.php?t=2954

Previous discussion of Uranex Limited can be found in the UNX thread: https://www.aussiestockforums.com/forums/showthread.php?t=2954