JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 3,936

- Reactions

- 5,772

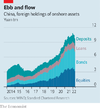

One of the positives will be China. The LNP brand is mud to the China political class, but now with the Labor Party running the show things will change and there will be smiles in some sections of China politics (and business leaders on both sides of the globe). The door to negotiation is slightly ajar, and with that the markets may factor in a small ray of hope. I haven't seen any commentary on this yet but the next few weeks will be interesting.

Market experts say market will respond well to a clear winner but be sensitive to big policy changes

The sharemarket will take Labor’s election win in its stride but will be sensitive in the coming months to any signs of loose fiscal policy that could spur higher inflation and force rates upward, market watchers say.

With Anthony Albanese claiming victory, economists and fund managers predict an overall muted reaction on the Australian Securities Exchange on Monday, with some tipping a potential boost for the energy sector, including in renewables, after the opposition went to the election promising stronger action on climate change.

Others warned the incoming Labor government would need to resist the temptation to flash the cash to cushion the impact of higher household costs, with this path only likely to fan the inflationary flames, hitting both consumers and business.

While SPI futures are pointing to a slight decline at the open, of 0.2 per cent, the sharemarket could get a mild boost from a more certain election outcome than many were expecting, CommSec chief economist Craig James said.

“The removal of uncertainty is a real positive for the markets and we’ve seen in past elections that when you get a clearer election result after the poll day then markets tend to respond positively.

“So instead of a downturn of 15 points (0.2 per cent), we might see something close to flat or even a small positive as investors start to work in the fact that the result came in widely as expected and, if anything, a little bit more positive that it’s not going to be a hung parliament.”

ENERGY

At the margin there might be increased interest in renewable-focused stocks, he added.

“There’s an expectation that there will be a greater focus on renewables from Labor. We still have to see the details of those policies, but in terms of broad trends, the renewable energy sector certainly has the potential for gains.”

The election outcome would help to resolve uncertainty in the energy sector, BetaShares chief economist David Bassanese said.

“A lot of investment in energy has been held back due to uncertainty but I think there will now be a lot more clarity now.

“Labor and the independents are committed to climate change and greater clarity in the shift to renewables. So businesses will now be able to invest with greater certainty in terms of the direction of energy policy in Australia.”

The sharemarket will also be weighing higher spending under Labor as well as rising costs for business, such as a 5 per cent lift in the minimum wage that will hit the retail and hospitality sectors hard, Tribeca portfolio manager Jun Bei Liu added.

“With a Labor government, we do expect a little bit more spending upfront. They have also talked to their support for a 5.1 per cent increase in minimum wage.

“All of that is going to add a little bit more inflationary pressure, and potentially means interest rates might have to go a little bit higher further down the road,” Ms Liu said.

Incoming Prime Minister Anthony Albanese this month said he supported a lift in the minimum wage that would see worker’s take-home pay “not going backwards”. Unions are calling for a 5.5 per cent jump in wages ahead of the Fair Work Commission’s decision expected in June.

LISTED FIRMS

Any ASX-listed companies that have very high labour costs could potentially come under pressure on the sharemarket because of the likely rise in the minimum wage, Ms Liu added.

The retail sector is already nursing bruising losses suffered on Thursday last week, when the broader sharemarket suffered its fifth-biggest drop of the year.

Among discretionary retailers, Wesfarmers plunged 7.8 per cent to $45.89, JB Hi-Fi tumbled 6.6 per cent, Super Retail Group lost 6 per cent and Harvey Norman fell 5.5 per cent. A portion of the losses were recovered in Friday’s session.

“About 20 per cent of our employment market is linked to the minimum wage (and awards). So if that rises by 5.1 per cent, that’s quite high compared to the previous trends and potentially those labour-intensive businesses will feel the impact. We’re talking retail, healthcare and even the banks,” Ms Liu warned.

CRYPTO

Crypto operators, meanwhile, will watch carefully for any regulatory shifts from the incoming government, BTC Markets chief executive Caroline Bowler said.

“A cross party Senate committee (in late 2021) reported on and made recommendations with regards to cryptocurrency regulation. So the expectation now is that the mantle passes on to the Labor government; we hope they pick that up and move forward with it,” Ms Bowler said.

“Certainly the industry has been pushing for appropriate regulation of our sector. This is the next trend coming through across the US, UK and Asia and for the incoming government the issue will be about making sure we stay abreast of these changes and that they are reflected appropriately within our own regulatory environment.”

HSBC chief economist Paul Bloxham cautioned on the difficult macro environment Labor is stepping in to.

“Labor faces quite a large challenge in terms of how to manage fiscal policy settings as inflation picks up in Australia,” Mr Bloxham warned.

“There is a role for fiscal policy to play, but if monetary policy is tightening and fiscal policy loosens in a substantial way, then that may very well put more pressure on the RBA, meaning they would have to lift interest rates even more.”

SPENDING

Any spending by the new government needs to be highly targeted, he said.

“To the extent that you provide direct support for households that are really hit by cost-of-living challenges, it’s got to be very targeted because the overall fiscal stance needs to consider the broader inflationary environment.

“Both monetary and fiscal policymakers are much more constrained now because inflation has picked up. There are just fewer options available but that‘s what higher inflation does; it limits options.”

One such targeted spending policy the Labor party has already committed to is its $5.4bn plan to boost childcare subsidies.

AMP chief economist Shane Oliver said there was a good argument to spend in this area to get more women back into the workforce and driving productivity gains.

But he urged the incoming government to avoid following the Coalition’s lead in giving cash handouts to struggling households.

“You could argue that the Coalition‘s approach in the last budget to support households, while understandable for social reasons, made the Reserve Bank’s job even harder,” Mr Oliver noted.

“So Labor will have to resist that approach and focus more on productivity enhancing measures.”

Part of the Albanese government’s issue as it comes in to power is it has a very narrow mandate as a result of having pursued a “small target strategy”, independent economist Saul Eslake said.

“In particular they have no mandate for budget repair. Nor do they really have any mandate for any reforms that might materially lift the abysmal rate of labour productivity growth that Australia has experienced over the past decade,” Mr Eslake warned.

Proposed changes to childcare and free TAFE courses would only make a difference to productivity “at the margins”, he cautioned.

“They are also bound by all the promises they made as to what they wouldn't do and now they have to work within that. They need to free themselves from those constraints ahead of the 2025 election.”

CLIONA O'DOWD