- Joined

- 15 September 2004

- Posts

- 364

- Reactions

- 2

I thought about posting this in the discussion on DJI, but I think this would be better as more of a general discussion.

I have a personal belief that in general economic growth will be limited over the next decade - mainly due to consumer debt (i may well be wrong).

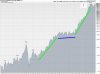

Below is a chart of the Dow Jones for the last 100 years - I couldn't find a suitable one of the All Ords??. The longer term cycles are reasonably well represented;

1940 - 60 strong growth

1960 - 80 flat

1980 - 2000 strong growth (crash of 87 recovered within a year)

2000 - ???

These periods are determined not really by sharemarket sentiment - they are driven by underlying economics.

My question is - are we heading into a long draw out period similar to 1960 - 1980?????

Two cliches? that have been well served from 1980 - 2000 (even considering 1987 crash);

Its time in the market, not timing the market

Buy and hold - thats not really a cliche

Is their day(decades) in the sun over?

My parents (babyboomers) were at a similar age to me during the 1960 - 1980 period, generational issues??

If anyone has an opinion, please post - I'm thinking on my feet with this stuff (not heavily researched), for the oldies are there similarities to 1960 with 2000??

Note: I don't think this is all doom and gloom, just a movement to a different cycle, money would have been both made and lost 1960-80.

TJ

I have a personal belief that in general economic growth will be limited over the next decade - mainly due to consumer debt (i may well be wrong).

Below is a chart of the Dow Jones for the last 100 years - I couldn't find a suitable one of the All Ords??. The longer term cycles are reasonably well represented;

1940 - 60 strong growth

1960 - 80 flat

1980 - 2000 strong growth (crash of 87 recovered within a year)

2000 - ???

These periods are determined not really by sharemarket sentiment - they are driven by underlying economics.

My question is - are we heading into a long draw out period similar to 1960 - 1980?????

Two cliches? that have been well served from 1980 - 2000 (even considering 1987 crash);

Its time in the market, not timing the market

Buy and hold - thats not really a cliche

Is their day(decades) in the sun over?

My parents (babyboomers) were at a similar age to me during the 1960 - 1980 period, generational issues??

If anyone has an opinion, please post - I'm thinking on my feet with this stuff (not heavily researched), for the oldies are there similarities to 1960 with 2000??

Note: I don't think this is all doom and gloom, just a movement to a different cycle, money would have been both made and lost 1960-80.

TJ