You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Long Term Investing

- Thread starter craft

- Start date

Basically my big picture of investing is swapping surplus capital for an ongoing income stream.

If you like, a chicken for its eggs, a cow for its milk, a sheep for its wool, sort of approach. What the approach does is get away from reliance on what the animal could be sold for down the track. The return stems from what the animal produces in relation to what I initially paid. The potential to sell becomes purely opportunity not a necessity

What’s the big picture behind your approach?

If you like, a chicken for its eggs, a cow for its milk, a sheep for its wool, sort of approach. What the approach does is get away from reliance on what the animal could be sold for down the track. The return stems from what the animal produces in relation to what I initially paid. The potential to sell becomes purely opportunity not a necessity

What’s the big picture behind your approach?

- Joined

- 25 July 2010

- Posts

- 1,120

- Reactions

- 284

Basically my big picture of investing is swapping surplus capital for an ongoing income stream.

...

What’s the big picture behind your approach?

This is essentially my approach also.

Basically, I've been very fortunate in my job and as a result would like to use this disposable income to purchase assets that form another income stream - which will feed into itself and grow both the capital deployed and the annual income from this capital.

This started as a result of seeing debt-fueled approaches in the property sector by various relatives, some racking up as much as 1.5mil in debt with an income barely enough to service that amount with current interest rates. Having witnessed what it does to your life, I have no interest in leveraging to make money, so everything I invest is my own.

So in a nutshell, I'm using my disposable income to purchase assets that will generate income and give a capital gain - using a value investing approach.

Having started about 13 months ago (injecting capital between now and then) off the back of only reading books and very little paper-trading, I'm sitting on a 33% capital gain + gross dividends of about 4% - so I'm pleased with my progress to date... but it's still early days.

Of course with the way the All-Ords is traveling, I might be behind the index soon! Lol

- Joined

- 5 March 2008

- Posts

- 951

- Reactions

- 141

Thanks Craft for this thread.

Ahhh, philosophy!

The big picture is to be financially comfortable, we are already there in semi-retirement. We have both business and property investments along with stockmarket investments, a large cash buffer and a defined benefit scheme super pension (wife from govt). I have greatly increased the stockmarket investments in the last 6 months into high dividend companies, usually small that have little debt. The intention is to keep these while they show positive results. I have also been using excess funds from trading profits for this purpose.

I like your analogy of swapping capital for chickens etc, it really is an underlying principle of what we are doing.

Looking at the big picture of where "things" in general are heading, on the investment side I see a continued decline in long term interest rates with a search for yield amongst those heading into retirement, essentially the babyboomers over the next few years. This will lead to a rush into anything that looks safe and has a reasonable yield. The trick will be to hold onto the chickens even though there is temptation to sell them when prices rise and just buy eggs.

What’s the big picture behind your approach?

Ahhh, philosophy!

The big picture is to be financially comfortable, we are already there in semi-retirement. We have both business and property investments along with stockmarket investments, a large cash buffer and a defined benefit scheme super pension (wife from govt). I have greatly increased the stockmarket investments in the last 6 months into high dividend companies, usually small that have little debt. The intention is to keep these while they show positive results. I have also been using excess funds from trading profits for this purpose.

I like your analogy of swapping capital for chickens etc, it really is an underlying principle of what we are doing.

Looking at the big picture of where "things" in general are heading, on the investment side I see a continued decline in long term interest rates with a search for yield amongst those heading into retirement, essentially the babyboomers over the next few years. This will lead to a rush into anything that looks safe and has a reasonable yield. The trick will be to hold onto the chickens even though there is temptation to sell them when prices rise and just buy eggs.

Big picture approach?

Achieve independence before I am too ill or too old to enjoy it!

My investment strategy is bet big when the odds are in my favour, the rest of the time is spent sitting on my hands.

My investment approach can be best described as:

50% Benjamin Graham

40% Humphrey Neill

10% Dartboard

Cheers

Oddson

Achieve independence before I am too ill or too old to enjoy it!

My investment strategy is bet big when the odds are in my favour, the rest of the time is spent sitting on my hands.

My investment approach can be best described as:

50% Benjamin Graham

40% Humphrey Neill

10% Dartboard

Cheers

Oddson

galumay

learner

- Joined

- 17 September 2011

- Posts

- 3,361

- Reactions

- 2,168

I am still to determine the most suitable strategy for myself, as readers of my thread on the subject will know I have been on a journey of learning prior to investing my capital in the market.

Broadly I share the views of the posters to date, looking to put capital and ongoing disposable income into shares, keen on long term investing with a view to ongoing income, love the animal husbandry analogies!

Broadly I share the views of the posters to date, looking to put capital and ongoing disposable income into shares, keen on long term investing with a view to ongoing income, love the animal husbandry analogies!

After a misspent youth investing to me meets a few needs starting when we established a SMSF about three years ago and continuing with my personal investments with a line of credit.

First of all I am looking to establish a passive income stream plus a nice lump sum of capital to open up options for my family and myself later in life.

Secondly I have found it to be a fascinating hobby, I love reading about businesses, industries and the markets and taking advantage when I think opportunity knocks.

There are many better analyst on this forum at using discount cash flow and ROIC and I am slowly learning and improving my skills. Having said that I think occasionally opportunities come along when it is obvious a business is trading at a substantial discount to intrinsic value, the most important thing then is to press the trigger and buy. This can be difficult amidst all the doom and gloom. It seems the last few years has been all volatility and doom and gloom I could not think of a better time to start investing. It will be interesting to see how I go at some point in the future when we are in a major bull market.

Oddson thank you for your reference to Humphrey Neill I had never heard of him - now his book is in the post to me.

First of all I am looking to establish a passive income stream plus a nice lump sum of capital to open up options for my family and myself later in life.

Secondly I have found it to be a fascinating hobby, I love reading about businesses, industries and the markets and taking advantage when I think opportunity knocks.

There are many better analyst on this forum at using discount cash flow and ROIC and I am slowly learning and improving my skills. Having said that I think occasionally opportunities come along when it is obvious a business is trading at a substantial discount to intrinsic value, the most important thing then is to press the trigger and buy. This can be difficult amidst all the doom and gloom. It seems the last few years has been all volatility and doom and gloom I could not think of a better time to start investing. It will be interesting to see how I go at some point in the future when we are in a major bull market.

Oddson thank you for your reference to Humphrey Neill I had never heard of him - now his book is in the post to me.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

Basically my big picture of investing is swapping surplus capital for an ongoing income stream.

Yeah i like that.

----------------------

I have found to my delight that the more i swap surplus capital for shares the more surplus capital i have...long term it just keeps building, with 6 month snap shots its all over the place but on calender and financial year terms its better every year.

The great advantage of long term investing is the time frame, you can actually "buy stocks cheap" and wait till someone will buy some of those shares from you for more than you paid for them, swapping shares for more surplus capital so that you can swap that capital for different shares...and so on.

And the dividends just keep rolling in and growing as your share collection (portfolio) grows...its great stuff, in mid 2007 when i started i received no dividends and now 5 and a half years later i get 45 dividend payments a year.

---------

My Big picture approach.

I have developed the LCEAA strategy (Low Cost Entry And Averaging) to build positions in stocks when the price is falling so that a low cost base can be established when the price rises and the more expensive parcels are sold off, thus lowing the average holding price and ensuring a high return on original capital invested via the dividend stream...redeploy freed up capital + surplus cash and repeat.

- Joined

- 15 February 2012

- Posts

- 27

- Reactions

- 0

I have developed the LCEAA strategy (Low Cost Entry And Averaging) to build positions in stocks when the price is falling so that a low cost base can be established when the price rises and the more expensive parcels are sold off, thus lowing the average holding price and ensuring a high return on original capital invested via the dividend stream...redeploy freed up capital + surplus cash and repeat.

This is just fudging numbers though? A shares a share regardless of what you paid for it.

This is just fudging numbers though? A shares a share regardless of what you paid for it.

OK, but it is good to pay less than you eventually sell it for right? and collect dividends along the way.

The two most important things in a share to me are, the quality of the underlying business and the price I have to pay to own a part of that.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

This is just fudging numbers though? A shares a share regardless of what you paid for it.

Well true in a way, but a complete crock in another.

There is a hell of a difference when comparing 100 shares in XYZ @ $1 each ($100) and 100 shares in XYZ @ $2 each ($200) the dividend is the same but the investment is not.

Basically my big picture of investing is swapping surplus capital for an ongoing income stream.

Good one liner of what I do and I imagine most of the long term investors as well...

I started in 2005 with modest amount, along the way a bit of luck, a bit of saving, a bit of work and a couple of massive multi baggers and fast forward 7 years later my dividend now outstripped my annual saving.

now I got dividend plus annual saving and that in turn generate more dividend the year after etc...

the key I found is 2 times your earning, once your capital reach 2 times your earning (what ever your earning is

be it 50K 80K 100K) you start generating more money from your capital than you can save..

and let compounding do the rest... most people don't stick around long enough to see the power of compounding....you can only see compounding effect in later years, first 5 years you probably wont see much of it but 10 years you will see it, 15 years you feel the power and 20 years you see its awesome power...

the stage I'm at, each year the compounding effect is so big I cant spent it all...I spent on holiday and toys and I still have left over...I don't mean wasteful spending but just spend like I would normally live my life..

gadgets, holiday, eat out etc...

Good luck, don't let short terms news and Mr Market control you..you should be calling the shot and when to swing even if 10 guys sit next to you shout swing you fool

A generic named thread for wide ranging discussion.

I hope people who are on a personal investing journey, find this thread and find it a good place to share their thoughts and experience.

I need to create passive income.

My partner (bless her

The long term plan is pretty simple/straight forward. Excess savings into mortgage, then also setting aside about 1500 per month into purchasing business to hold for the longterm cashflow.

At the end of the 10 year period. We should hold a fully paid off PPOR and about 250,000-400,000 in stock capital (allowing a bit of a range depedent upon returns. At which point I will also be able to use the equity in the PPOR to finance an investment property (While im still working).

The vast majority of the time my investing is done by fundamental analysis .. but incorporate a bit of trend eyeing as well ... because sometimes even when I get it right I get it wrong. i unloaded into CSL around 27, stepping out about the 35 thinking id made a great little deal and should probably jump seeing as I believed to be fully priced .. only to watch it now sail all the way to 56

So hopefully in 10 years time I will be 35 and she will be 33, I think at this point we could quite easily have accumulated 1m+ in assets if the plan goes ok. She will be able to reduce her working hours (its probably we could look at starting a family at this time)

I hope we can get there as ROE alluded to ... so that we can feel the full power of compounding. TBH once we have accumulated those assets theres probably not a whole lot more accumulating we will need to do, I can continue working past that point to finance and pay for the dream home. The assets should be able to just about compound themselves.

I need to create passive income.

My partner (bless her) although being the busiest and most organised person on the planet... hates her job and hates going to work ... she hates it ... I can see the look in her eyes and I know she will not be able to put up with it in the longterm. I need to create passive income quick smart to allow her the time to either reduce her working hours (which she does alot) or to allow her time to find her career passion. We have a smortgage but thats on track to be completely paid off in 10yrs.

The long term plan is pretty simple/straight forward. Excess savings into mortgage, then also setting aside about 1500 per month into purchasing business to hold for the longterm cashflow.

If you were to pay the additional 1500/month into the mortgage how much quicker could this be paid off?

Unless you can generate returns of 9-10% (say 7% after 30% tax is paid) you might be better off getting the bank off your back asap.

An alternative (and only if you are comfortable to do so) would be to take out an investment loan to buy your portfolio, at least this way the interest would be deductible...

Not advice (as im not an accountant!)

- Joined

- 15 February 2012

- Posts

- 27

- Reactions

- 0

Well true in a way, but a complete crock in another.

There is a hell of a difference when comparing 100 shares in XYZ @ $1 each ($100) and 100 shares in XYZ @ $2 each ($200) the dividend is the same but the investment is not.

This is true, but once you've bought them at either $1 or $2 it doesn't matter anymore.

I agree with the rest of what your saying, but the idea of selling the highest cost packet really only affects the tax man. To make it a key point of your 'strategy' to me, is just a way of getting higher % returns on paper, when the total dollar return is the same. This is the same with your concept of 'free-hold', to me a dollar is a dollar regardless of how it was earned.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

This is true, but once you've bought them at either $1 or $2 it doesn't matter anymore.

I would argue that you still have to sell the $2 shares at a profit (break even minimum) so that your strategy is profitable, the $2 purchase price has to be low enough to realise a profit opportunity in the shortest possible time frame so that capital can be recycled.

The LCE in LCEAA stands for 'Low Cost Entry' the averaging only comes into play if the entry wasn't low enough..i like to say this isn't rocket science, buy good stocks cheap and sell em for more than you paid for them, i think its easier and safer to do this, than say buying expensive good stocks and selling them for more than you paid for them.

- Joined

- 22 November 2010

- Posts

- 3,661

- Reactions

- 9

... buy good stocks cheap and sell em for more than you paid for them, i think its easier and safer to do this, than say buying expensive good stocks and selling them for more than you paid for them.

You make it sound far easier than it is.

No one here will tell you if a company is cheap or if a company is expensive.

Ask anyone for an intrinsic value on IRI for example!!

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

No one here will tell you if a company is cheap or if a company is expensive.

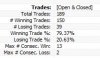

I will...i do it all the time in the stock threads...and with an open time frame im right close to 90% (on per stock basis) of the time (especially with this rally

~

Attachments

galumay

learner

- Joined

- 17 September 2011

- Posts

- 3,361

- Reactions

- 2,168

I will...i do it all the time in the stock threads...and with an open time frame im right close to 90% (on per stock basis) of the time (especially with this rally)

~

To be honest the % of being right is less important that how right you are! If you 'win' 80% of the time but only make an average of 5% profit and on the 20% of losses you lose 80% of your investment - then you are a long way behind!

.....i like to say this isn't rocket science, buy good stocks cheap and sell em for more than you paid for them, i think its easier and safer to do this, than say buying expensive good stocks and selling them for more than you paid for them.

Agree 100%.

I always like to point out that when Charlie Munger talks about the Washington Post purchase (which every investing book seems to talk about) he states it was a 1 in a 40 year bet. Think about it....

Another good bedtime read from Tweedy Browne

http://thetaoofwealth.files.wordpress.com/2013/01/great-10-year-record-great-future-right.pdf

The number of opportunities where an investor with certainty can predict the future growth is rare. Why focus on these bets? An opportunity where an investor can competently assess the future with certainty and be trading at a fair price may never come along in their investing lifetime!

Follow the market. Buy cheap. Manage the portfolio.

A question for the investors who have had multibaggers - with hindsight was it easy to see features that led to the growth?

http://guythomas.org.uk/blog/?e=22