Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

I'm a relative novice to investing/tradeing charting and am sometimes confronted with the problem of which to use.

Generally I use linear as most of my charting is short term.

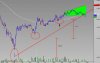

It seems to me that the dollar and percentage numbers are the same whichever you use, but there can be a significant difference in charting trendlines over time.

What are the pro's and con's of linear and log charting?

When should each be used and why?

What do people use?

Generally I use linear as most of my charting is short term.

It seems to me that the dollar and percentage numbers are the same whichever you use, but there can be a significant difference in charting trendlines over time.

What are the pro's and con's of linear and log charting?

When should each be used and why?

What do people use?