- Joined

- 4 April 2014

- Posts

- 99

- Reactions

- 53

Hi again,

Sorry for all the posts..

I've been reading the barefoot investor and the author seems to like LICs.. He mentioned AFIC as one of his suggestions.

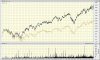

So I looked up AFIC and compared it to the Index and saw how the Index is beating this LIC,

So I have a question. Is there any logic in someone investing in AFI if it can't beat the index? I do understand that this fund doesn't track the index and is not an index fund and that just because its not beating the index it doesn't mean its not making a profit.

However, one had to choose to invest in AFI or say an index fund like VAS in comparison, then what would be a logical reason to pay a higher fee and choose AFI over VAS?

I have been under the impression that its all about trying to beat the index and that if a non index fund /LIC /ETF can't do this then there is no point in paying a premium for it, is this right?

-Frank

Sorry for all the posts..

I've been reading the barefoot investor and the author seems to like LICs.. He mentioned AFIC as one of his suggestions.

So I looked up AFIC and compared it to the Index and saw how the Index is beating this LIC,

So I have a question. Is there any logic in someone investing in AFI if it can't beat the index? I do understand that this fund doesn't track the index and is not an index fund and that just because its not beating the index it doesn't mean its not making a profit.

However, one had to choose to invest in AFI or say an index fund like VAS in comparison, then what would be a logical reason to pay a higher fee and choose AFI over VAS?

I have been under the impression that its all about trying to beat the index and that if a non index fund /LIC /ETF can't do this then there is no point in paying a premium for it, is this right?

-Frank