Modest

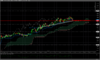

It's in the chart

- Joined

- 7 September 2012

- Posts

- 2,212

- Reactions

- 480

Opened up a demo account with Pepperstone using their cTrader software this week. I love the platform.

Excuse my arrogance but I having trouble understanding how brokers will give _anyone_ $100,000 to play with so long as they deposit $1,000...

My n00b questions:

What if a trader (with the above leverage example) opens up a position makes a loss of say, $10,000 and closes the position.

The trader has lost $10,000 of the brokers own money!

Does that mean the trader has a personal debt of $9,000 now which they must repay the broker with?

I am just having trouble understanding how brokers can offer such massive amounts of money willy nilly style?

How is the broker paid back? What does the broker get out of all this?

mind = blown

Excuse my arrogance but I having trouble understanding how brokers will give _anyone_ $100,000 to play with so long as they deposit $1,000...

My n00b questions:

What if a trader (with the above leverage example) opens up a position makes a loss of say, $10,000 and closes the position.

The trader has lost $10,000 of the brokers own money!

Does that mean the trader has a personal debt of $9,000 now which they must repay the broker with?

I am just having trouble understanding how brokers can offer such massive amounts of money willy nilly style?

How is the broker paid back? What does the broker get out of all this?

mind = blown