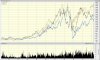

OK, this is a bit disconcerting as a newbie to shares

I've just heard on Your Money Your Call

Sometime early March 2011 (It was recorded)

That over the last 10 years, despite mining boom and enormous profits from mining

You would have made more if you had David Jones shares

than either BHP or RIO

Can this be true?

Please someone stop me going out to buy DJS or similar

I've just heard on Your Money Your Call

Sometime early March 2011 (It was recorded)

That over the last 10 years, despite mining boom and enormous profits from mining

You would have made more if you had David Jones shares

than either BHP or RIO

Can this be true?

Please someone stop me going out to buy DJS or similar