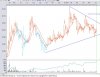

Put this one in your watchlist as all the fundamentals are excellent and it has formed a Darvas box, a buy at a break of 77 cents. Seems there was an investors presentation in Perth today and it was interesting to see the market depth that there was one buyer @ 600,000 shares at 65cents closing at 68 cents. This stock is very tightly held with volume of about 50,000 to 300,000 per day, unless a large break out like in late January to 77 cents when over 900,000 shared exchanged hands. I have a profit target at a conservative 90 cents, some brokers have a potential value of up to $2. The graph speaks for itself ie excellent OBV etc.

Kind regards

Ang

Kind regards

Ang