skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Description from Iress

Market cap ~$8m. Guidance for FY14 is $0.55-0.65m NPAT following Q1 profit growth of 44%.

Clean balance sheet with no debt and cash ~$1.1m.

DYOR (I hold)

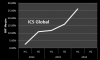

ICSGlobal Limited (ICS) is a holding company with a 100% owned subsidiary

involved in medical billing services. ICS provides medical billing services to

the United Kingdom and has registered office in Australia.

OPERATION: The sole operating business of the company is Medical Billing &

Collection (MBC) business in the UK. This business advises medical consultants

and specialists on their billing processes and collects debts on their behalf.

ICS is also seeking new Australian business opportunities.

Market cap ~$8m. Guidance for FY14 is $0.55-0.65m NPAT following Q1 profit growth of 44%.

Clean balance sheet with no debt and cash ~$1.1m.

DYOR (I hold)