When people start trading they often focus on increasing the revenue (or profit) of their account and neglect the expenses (or costs) of trading. Instead of trying to improve your “edge” in the market, a much easier way of improving your profitability is to decrease the costs associated with operating your account.

Most of us love a sale and will spend hours researching a product to get the best price possible. Gaining a better entry price by using different order types is the trader’s version of a sale. Being smart and learning how to shave $0.02 off the entry price of a trade is the same as saving $100 on that new computer you just purchased. They both put money back in your pocket!

There are a number of order types at the disposal of the trader. Some of them are very complex and each have advantages and disadvantages. Which order type a trader ultimately uses depends on the type of trade they are executing and what they are trying to achieve in the trade. Learning how to use each of them to their strengths can turn that 3% return into a 5% return with little effort, especially when you are trading shares that have a low value. Improving your entry price by $0.001 on a $0.02 share can save you 5%. Think about that for a second. Without changing anything else about your trading you have just generated 5% out of thin air by only changing the way you enter a trade!

For this reason order execution is an important aspect of trading. Just as a golfer must choose what he believes to be the best club for the shot he is about to play, a trader must choose the best order entry method for that particular trade. Simply placing every order at market is like the golfer always using a 3 iron. He may finish the round, however his score will be significantly worse than if he had used all the clubs in his bag. A trader should use every resource at their disposal to gain the best possible entry price and therefore give themselves the best chance of success in the trade. In this article I will run through some of the most common order types and how they can be used to increase your overall profitability.

The most common order types available to a trader are market, limit and stop orders.

A market order is executed as soon as you place the order and is filled at the best possible price available at that time.

It effectively says to the market “I don’t care what price I enter the trade as long as I am filled.” This may sound like it is an ineffective strategy, one that could only increase your entry price however there are times that this type of order is favoured.

Let’s look at an example. Say you identify a trade that has gapped up with an increase in volume indicating good buying support. If you believe momentum will continue a quick entry is crucial. The most effective way to execute this order would be via a market order using an online broker. This is because you do not have to specify a price; the order is placed straight into the market and filled at the best possible price at that time. In a liquid market with high turnover the order is usually filled immediately at the offer price.

The effectiveness of a market orders speed however is limited in a market that is illiquid. Let’s look at another example:

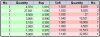

Consider the screenshot of a company’s market depth below.

What if you were looking to purchase 13,050 shares and used a market order through an online broker to enter the trade. The online broker cannot use discretion and must fill the order as quickly as possible at the best price available at that moment in time. For this reason it is worth knowing how your online broker executes market orders when dealing in illiquid stocks.

Most brokers fill your order within 3 price steps of the current offer price. If you are trying to purchase a number that is greater than the total quantity on offer within those price steps the remainder is typically placed on the bid at a limit price and cancelled at the end of the day. This may mean that you are not filled on the entire order and as a result your position size and therefore risk in the trade is lower than expected.

A more effective entry method to use on illiquid stocks is by entering the trade via a limit order.

A limit order is one where the trader specifies a maximum price that he wishes to enter a trade at. The order can be filled at a lower price than specified but cannot be filled at a price that is higher than the “limit”.

A limit order can also be useful for trading stocks such as Telstra which usually have a large quantity on the bid an offer and tend to trade in a small range on most days. If the trader spots a large quantity on the offer and a small quantity on the bid by comparison the trader can place his order to enter the trade at the bid price. As placing a market order would have them filled at the offer price, they have effectively saved themselves the difference between the bid and the offer. To give you a practical example you could take the below market depth.

If you placed your order at a limit of $0.013 and got filled instead of placing a market order and being filled straight away you would save yourself 7.69%. If your trading 1,000,000 shares (being a trade worth about $13,000) that is a saving of $1,000. Not a bad saving for a minimal amount of work!

The downside to placing a limit order is it may require the trader to sit in front of a computer watching the price action until the order has been completely filled so that the trader is confident that their order has executed.

They may also require access to real time data and level 2 market depth (meaning they see multiple lines of the market depth like the screenshot above). Not all traders have access to these facilities and watching a screen all day is not a viable option to most people.

The last order type that I will talk about is a stop order. A stop order is usually used as an exit point from your trade but can also be used as a trigger point to enter a trade.

A stop order is one that executes a trade when the share price reaches a certain level. This order is not active until your specified price has been achieved. When it does become active the order is executed as a market order.

Lost yet? Don’t worry, I will run through an example to help explain things.

Say you trade breakouts and you have identified a share with heavy resistance at $4.00. You think that if the price breaks this level and hits $4.05 then it’s likely that the share price will continue to rally towards $5.00.

Currently the share price has been hovering around $3.80 but you don’t have the time to continue to sit there and watch the price until it breaks the $4.00 level. In this case you can use a stop order to automatically enter the trade once it hits $4.05.

Placing a stop at $4.05 will therefore keep your trade in the background until the share price hits $4.05. Once it does a market order will be placed and execute the trade at the best possible price. Using this order will get you in the trade and save you missing the trade and the potential profits that go along with it.

As you may already know it is the same when placing a stop to exit a trade and protect your capital.

The main advantage of the stop order is convenience. It allows you to set orders to enter or exit trades without needed to constantly monitor your trades. Considering our lives are getting busier by the day this type of order is a blessing for those that have other commitments. The biggest downfall of this order type however is you often experience slippage when the trade does execute.

Slippage is when your order gets filled at a different price than expected. Take the above example where we had a stop order to enter a trade at $4.05. You may not be the only trader with a stop order to enter at that level and as a result there may be a lot of buyers trying to enter a trade at $4.05.

If the stock is illiquid and doesn’t have very many shares on offer at $4.05 the share price could increase rapidly.

As you know from the above explanation, as soon the share price hits $4.05 your order is executed as a market order and filled at the best possible price. In this case the share price may shoot straight past $4.05 and you may get filled at $4.08 or even $4.11 depending on how liquid the company is and how many traders are trying to purchase shares at the same price.

It is therefore critical that you know how these orders work before placing them so that you can work out how to use them in the most efficient way for your strategy. Making this small change to your trading method can greatly improve the profitability of your already successful strategy. Of course you do also need a strategy that is profitable.

Most of us love a sale and will spend hours researching a product to get the best price possible. Gaining a better entry price by using different order types is the trader’s version of a sale. Being smart and learning how to shave $0.02 off the entry price of a trade is the same as saving $100 on that new computer you just purchased. They both put money back in your pocket!

There are a number of order types at the disposal of the trader. Some of them are very complex and each have advantages and disadvantages. Which order type a trader ultimately uses depends on the type of trade they are executing and what they are trying to achieve in the trade. Learning how to use each of them to their strengths can turn that 3% return into a 5% return with little effort, especially when you are trading shares that have a low value. Improving your entry price by $0.001 on a $0.02 share can save you 5%. Think about that for a second. Without changing anything else about your trading you have just generated 5% out of thin air by only changing the way you enter a trade!

For this reason order execution is an important aspect of trading. Just as a golfer must choose what he believes to be the best club for the shot he is about to play, a trader must choose the best order entry method for that particular trade. Simply placing every order at market is like the golfer always using a 3 iron. He may finish the round, however his score will be significantly worse than if he had used all the clubs in his bag. A trader should use every resource at their disposal to gain the best possible entry price and therefore give themselves the best chance of success in the trade. In this article I will run through some of the most common order types and how they can be used to increase your overall profitability.

The most common order types available to a trader are market, limit and stop orders.

A market order is executed as soon as you place the order and is filled at the best possible price available at that time.

It effectively says to the market “I don’t care what price I enter the trade as long as I am filled.” This may sound like it is an ineffective strategy, one that could only increase your entry price however there are times that this type of order is favoured.

Let’s look at an example. Say you identify a trade that has gapped up with an increase in volume indicating good buying support. If you believe momentum will continue a quick entry is crucial. The most effective way to execute this order would be via a market order using an online broker. This is because you do not have to specify a price; the order is placed straight into the market and filled at the best possible price at that time. In a liquid market with high turnover the order is usually filled immediately at the offer price.

The effectiveness of a market orders speed however is limited in a market that is illiquid. Let’s look at another example:

Consider the screenshot of a company’s market depth below.

What if you were looking to purchase 13,050 shares and used a market order through an online broker to enter the trade. The online broker cannot use discretion and must fill the order as quickly as possible at the best price available at that moment in time. For this reason it is worth knowing how your online broker executes market orders when dealing in illiquid stocks.

Most brokers fill your order within 3 price steps of the current offer price. If you are trying to purchase a number that is greater than the total quantity on offer within those price steps the remainder is typically placed on the bid at a limit price and cancelled at the end of the day. This may mean that you are not filled on the entire order and as a result your position size and therefore risk in the trade is lower than expected.

A more effective entry method to use on illiquid stocks is by entering the trade via a limit order.

A limit order is one where the trader specifies a maximum price that he wishes to enter a trade at. The order can be filled at a lower price than specified but cannot be filled at a price that is higher than the “limit”.

A limit order can also be useful for trading stocks such as Telstra which usually have a large quantity on the bid an offer and tend to trade in a small range on most days. If the trader spots a large quantity on the offer and a small quantity on the bid by comparison the trader can place his order to enter the trade at the bid price. As placing a market order would have them filled at the offer price, they have effectively saved themselves the difference between the bid and the offer. To give you a practical example you could take the below market depth.

If you placed your order at a limit of $0.013 and got filled instead of placing a market order and being filled straight away you would save yourself 7.69%. If your trading 1,000,000 shares (being a trade worth about $13,000) that is a saving of $1,000. Not a bad saving for a minimal amount of work!

The downside to placing a limit order is it may require the trader to sit in front of a computer watching the price action until the order has been completely filled so that the trader is confident that their order has executed.

They may also require access to real time data and level 2 market depth (meaning they see multiple lines of the market depth like the screenshot above). Not all traders have access to these facilities and watching a screen all day is not a viable option to most people.

The last order type that I will talk about is a stop order. A stop order is usually used as an exit point from your trade but can also be used as a trigger point to enter a trade.

A stop order is one that executes a trade when the share price reaches a certain level. This order is not active until your specified price has been achieved. When it does become active the order is executed as a market order.

Lost yet? Don’t worry, I will run through an example to help explain things.

Say you trade breakouts and you have identified a share with heavy resistance at $4.00. You think that if the price breaks this level and hits $4.05 then it’s likely that the share price will continue to rally towards $5.00.

Currently the share price has been hovering around $3.80 but you don’t have the time to continue to sit there and watch the price until it breaks the $4.00 level. In this case you can use a stop order to automatically enter the trade once it hits $4.05.

Placing a stop at $4.05 will therefore keep your trade in the background until the share price hits $4.05. Once it does a market order will be placed and execute the trade at the best possible price. Using this order will get you in the trade and save you missing the trade and the potential profits that go along with it.

As you may already know it is the same when placing a stop to exit a trade and protect your capital.

The main advantage of the stop order is convenience. It allows you to set orders to enter or exit trades without needed to constantly monitor your trades. Considering our lives are getting busier by the day this type of order is a blessing for those that have other commitments. The biggest downfall of this order type however is you often experience slippage when the trade does execute.

Slippage is when your order gets filled at a different price than expected. Take the above example where we had a stop order to enter a trade at $4.05. You may not be the only trader with a stop order to enter at that level and as a result there may be a lot of buyers trying to enter a trade at $4.05.

If the stock is illiquid and doesn’t have very many shares on offer at $4.05 the share price could increase rapidly.

As you know from the above explanation, as soon the share price hits $4.05 your order is executed as a market order and filled at the best possible price. In this case the share price may shoot straight past $4.05 and you may get filled at $4.08 or even $4.11 depending on how liquid the company is and how many traders are trying to purchase shares at the same price.

It is therefore critical that you know how these orders work before placing them so that you can work out how to use them in the most efficient way for your strategy. Making this small change to your trading method can greatly improve the profitability of your already successful strategy. Of course you do also need a strategy that is profitable.