You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Futures and CFD trading

- Thread starter Alvin

- Start date

- Joined

- 24 June 2004

- Posts

- 302

- Reactions

- 1

Hi Alvin,

do trade a variety of instrutments.

Options for leverage - short time frame (daytrades 1-7 days + for free option trades)

Warrants for dividend capture (4 weeks average)

CFD's (day trades)

Margin Lending - (1-7 days) but have a T7 with my broker.

favourite trades would be the Option Trades, due to free trades, if you can draw your capital out and leave your profit at risk.

Margin Lending on T7 - much higher risk, but trading on almost completly on credit.

eg.. Mayne Chart Example.

https://www.aussiestockforums.com/forums/showthread.php?p=4424#post4424

Meaning of T7 - you have 7 days to come up with the balance owing for that trade, if you can buy and sell that position with in the 7 days, the profit and loss are offset against each other, within that trade.

eg... Mayne bought 20,000 units @ $4.26

Will hold out as far as i can to the T7

(profit target $4.38 - $4.40 for the 7 days)

if target is hit.

$4.40 - $4.26 = 14 cents profit

14 cents x 20,000 units = $2,800

minus brokerage of $300 each way

$2,800 - $600 = $2,200 profit

ROI = Profit ($2,200) divided by Brokerage ($600)

$2,200 / $600 = 3.6 (x 100 to give percent)

Profit as a percent = 360% ROI

please note ( this is a very high risk trade, an example of entry would be like the Mayne Link above, though this might be typical, on an intraday trade, based on annoncement or news. )

though how did i get into the derivatives products, is mainly by my broker, holding my hand as i learn new trading strategies, suggestions of trades that are very bullish, by positive indicators and using derivatives to further leverage the gains..

Cheers,

sis

do trade a variety of instrutments.

Options for leverage - short time frame (daytrades 1-7 days + for free option trades)

Warrants for dividend capture (4 weeks average)

CFD's (day trades)

Margin Lending - (1-7 days) but have a T7 with my broker.

favourite trades would be the Option Trades, due to free trades, if you can draw your capital out and leave your profit at risk.

Margin Lending on T7 - much higher risk, but trading on almost completly on credit.

eg.. Mayne Chart Example.

https://www.aussiestockforums.com/forums/showthread.php?p=4424#post4424

Meaning of T7 - you have 7 days to come up with the balance owing for that trade, if you can buy and sell that position with in the 7 days, the profit and loss are offset against each other, within that trade.

eg... Mayne bought 20,000 units @ $4.26

Will hold out as far as i can to the T7

(profit target $4.38 - $4.40 for the 7 days)

if target is hit.

$4.40 - $4.26 = 14 cents profit

14 cents x 20,000 units = $2,800

minus brokerage of $300 each way

$2,800 - $600 = $2,200 profit

ROI = Profit ($2,200) divided by Brokerage ($600)

$2,200 / $600 = 3.6 (x 100 to give percent)

Profit as a percent = 360% ROI

please note ( this is a very high risk trade, an example of entry would be like the Mayne Link above, though this might be typical, on an intraday trade, based on annoncement or news. )

though how did i get into the derivatives products, is mainly by my broker, holding my hand as i learn new trading strategies, suggestions of trades that are very bullish, by positive indicators and using derivatives to further leverage the gains..

Cheers,

sis

- Joined

- 9 July 2004

- Posts

- 193

- Reactions

- 0

Hi SIS,

Cheers,

J.

Your strategies are geared for the bull market. How are you planning to change your strategy(ies) once a bear market kicks in? Would you do the opposite - ie sell the stock short, buy a call option as your hedge etc.suggestions of trades that are very bullish

Cheers,

J.

- Joined

- 24 June 2004

- Posts

- 302

- Reactions

- 1

Hi PositiveCashFlow,

long time no hear...

pretty much exactly the opposite... of what im doing, and exactly what you mention above....

will do plenty of shorts and puts on stocks and options, and probably changing most my trading to just seasonal trading, once the bear market moves in....

Cheers,

sis

glad to hear from you, long time no hear...

long time no hear...

pretty much exactly the opposite... of what im doing, and exactly what you mention above....

will do plenty of shorts and puts on stocks and options, and probably changing most my trading to just seasonal trading, once the bear market moves in....

Cheers,

sis

glad to hear from you, long time no hear...

- Joined

- 9 July 2004

- Posts

- 193

- Reactions

- 0

Hey SIS,

You never reply to my MSN msgs.. LOL.. Anyways sounds like you've done very well in your trading... I see your still in love with MRL .

.

Cheers,

J.

You never reply to my MSN msgs.. LOL.. Anyways sounds like you've done very well in your trading... I see your still in love with MRL

Cheers,

J.

- Joined

- 24 June 2004

- Posts

- 302

- Reactions

- 1

Hi PositiveCashFlow,

it varies, everyday, because im on a different computer to where MSN is running, but if you remember, when i came down to Sydney, i was still online even though i was many many km's away from the computer screen.. lol... ill fix up that up later on, and put a message on there that say... not at this screen at the moment....

but, how are things going for you, i heard about a course you did, i hope it does you very well... as i do believe, that you will be an option expert one day...

Cheers,

sis

it varies, everyday, because im on a different computer to where MSN is running, but if you remember, when i came down to Sydney, i was still online even though i was many many km's away from the computer screen.. lol... ill fix up that up later on, and put a message on there that say... not at this screen at the moment....

but, how are things going for you, i heard about a course you did, i hope it does you very well... as i do believe, that you will be an option expert one day...

Cheers,

sis

- Joined

- 9 July 2004

- Posts

- 193

- Reactions

- 0

SiS,

). When are u next coming down to Syd?

). When are u next coming down to Syd?

Cheers,

J.

I'll tell you all about it when we next chat on MSN. (I am also trying to brainwash PropertyGuru and Jetdollars - LOLstill_in_school said:i heard about a course you did

). When are u next coming down to Syd?

). When are u next coming down to Syd?Cheers,

J.

i started trading cfds about a year ago. I have learnt alot along the way the hard part is getting consistent. some months you have 10 profitable trades in a row other months like feb when its volitile as its tough.. i use www.cfdtools.com to get info about providers. ive switched a few times already. initially i traded with cmc because is saw the cheapest commissions from my experience dma is much better and i am now with man

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Another old thread but relevant to my question.

Does anyone have their stop losses hit consistently?The reason I ask is 10/10 trades my stop losses were hit and 5 only just tipped.This is a frequent event with trading CFD`s and although i have moved my stops further from the entry (out of immediate range) they are strangely hunted down and taken out.

Even more unusual is the splinters that get thrown out (tails,spikes etc.)

I cannot believe that my stop losses are hit frequently by spikes or tipped and then reversing.Does this happen to anyone and if so would you be interested in investigating the events further.

I think it is deliberate and constitutes illegal practice.

Does anyone have their stop losses hit consistently?The reason I ask is 10/10 trades my stop losses were hit and 5 only just tipped.This is a frequent event with trading CFD`s and although i have moved my stops further from the entry (out of immediate range) they are strangely hunted down and taken out.

Even more unusual is the splinters that get thrown out (tails,spikes etc.)

I cannot believe that my stop losses are hit frequently by spikes or tipped and then reversing.Does this happen to anyone and if so would you be interested in investigating the events further.

I think it is deliberate and constitutes illegal practice.

- Joined

- 12 May 2008

- Posts

- 499

- Reactions

- 7

Another old thread but relevant to my question.

Does anyone have their stop losses hit consistently?The reason I ask is 10/10 trades my stop losses were hit and 5 only just tipped.This is a frequent event with trading CFD`s and although i have moved my stops further from the entry (out of immediate range) they are strangely hunted down and taken out.

Even more unusual is the splinters that get thrown out (tails,spikes etc.)

I cannot believe that my stop losses are hit frequently by spikes or tipped and then reversing.Does this happen to anyone and if so would you be interested in investigating the events further.

I think it is deliberate and constitutes illegal practice.

Wysiwyg

what are you trading exactly?

if its index CFDs, these charts should replicate the futures charts when over-layed -- preventing, or at least minimising, this type of behaviour during cash market hours.

i also find an 8 to 10 pnt stop works fine on the SPI and FTSE - but it stops working well when my entry timing becomes poor.

James

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Wysiwyg

what are you trading exactly?

if its index CFDs, these charts should replicate the futures charts when over-layed -- preventing, or at least minimising, this type of behaviour during cash market hours.

i also find an 8 to 10 pnt stop works fine on the SPI and FTSE - but it stops working well when my entry timing becomes poor.

James

Hi James, I traded the `aussie 200 cash`, `wall street cash`, spot gold and foreign exchange.

Yes i use 7 to 12 point stops depending and they are consistently getting touched but not continueing on trend.I trade on trend (sometimes counter-trend) and when I move the stop out 15 - 20 points they get touched too.

I`m talking about tipped out of trades before major moves, tipped out of trades and then back on trend.Even the spread price (one tick) touching and then reversing. Real weird stuff.

I concede i am wrong too but this is beyond acceptable and want to know if others have the same happen.

If it is normal then i won`t be using CFD`s again but if it is the provider then i will investigate further.I believe it is deliberate.

- Joined

- 12 May 2008

- Posts

- 499

- Reactions

- 7

Hi James, I traded the `aussie 200 cash`, `wall street cash`, spot gold and foreign exchange.

Yes i use 7 to 12 point stops depending and they are consistently getting touched but not continueing on trend.I trade on trend (sometimes counter-trend) and when I move the stop out 15 - 20 points they get touched too.

I`m talking about tipped out of trades before major moves, tipped out of trades and then back on trend.Even the spread price (one tick) touching and then reversing. Real weird stuff.

I concede i am wrong too but this is beyond acceptable and want to know if others have the same happen.

If it is normal then i won`t be using CFD`s again but if it is the provider then i will investigate further.I believe it is deliberate.

i can only speak for indices, dont trade the others, but the only way to determine if hanky-panky is occurring, is to compare the CFD chart to the futures chart. if there is a discrepancy at each 1 min candle u r stopped,

then hmmm . . . .

otherwise you might want to look at your entries and your stop placement.

but i can understand your frustration

good luck

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

i can only speak for indices, dont trade the others, but the only way to determine if hanky-panky is occurring, is to compare the CFD chart to the futures chart. if there is a discrepancy at each 1 min candle u r stopped,

then hmmm . . . .

otherwise you might want to look at your entries and your stop placement.

but i can understand your frustration

good luck

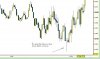

Okay thanks, here is a chart of the first event today.Gold buy entry at level on chart with stop loss below.This is what happens.

It is not the matching with futures charts i am concerned with.It is the powerless feeling that your protective stops can be taken out any time at any position.

Attachments

- Joined

- 12 May 2008

- Posts

- 499

- Reactions

- 7

It is not the matching with futures charts i am concerned with.It is the powerless feeling that your protective stops can be taken out any time at any position.

your stops can only be taken out repeatedly if:

A) your provider is up to no good as is your suspicion

B) your entry/stop placement are not working

if you cant prove A) then you might want to look at B)

James

Hi Wys,

I don't post much as I have very bad eyes so just a quick one, IMO opinion that was a poorly placed stop.

If you are long, then your stop needs to be below the round number not above.

All that price did was to test $909 and you got stopped out, your stop should have been 908.9 or similar.

If you can't afford to put the stop on "the other side" of round numbers then you need better entry points.

Do some research this way, choose the best place to put your stop, then work out your entry

HTH

I don't post much as I have very bad eyes so just a quick one, IMO opinion that was a poorly placed stop.

If you are long, then your stop needs to be below the round number not above.

All that price did was to test $909 and you got stopped out, your stop should have been 908.9 or similar.

If you can't afford to put the stop on "the other side" of round numbers then you need better entry points.

Do some research this way, choose the best place to put your stop, then work out your entry

HTH

- Joined

- 5 August 2008

- Posts

- 1

- Reactions

- 0

"I`m talking about tipped out of trades before major moves, tipped out of trades and then back on trend.Even the spread price (one tick) touching and then reversing. Real weird stuff"

Well, try and bear in mind how your provider gets paid. If your provider receives a fee (and possibly some margin) when you trade, there is an incentive to trade as often as possible. This is why I only leave "take profit" orders with my broker (because I want my broker to work hard to fill these) and manage "stop losses" myself.

Well, try and bear in mind how your provider gets paid. If your provider receives a fee (and possibly some margin) when you trade, there is an incentive to trade as often as possible. This is why I only leave "take profit" orders with my broker (because I want my broker to work hard to fill these) and manage "stop losses" myself.

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

"I`m talking about tipped out of trades before major moves, tipped out of trades and then back on trend.Even the spread price (one tick) touching and then reversing. Real weird stuff"

Well, try and bear in mind how your provider gets paid. If your provider receives a fee (and possibly some margin) when you trade, there is an incentive to trade as often as possible. This is why I only leave "take profit" orders with my broker (because I want my broker to work hard to fill these) and manage "stop losses" myself.

That is interesting because i had another crack at forex and indices this week and the same happened as last time.One tick hits on my stops.

Even swings in my favour were short lived when tick returns to my break even or slightly better.

If i ever have another go i will try the method you suggest but there is something fishy about CFD providers and it is starting to rot.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 204

That is interesting because i had another crack at forex and indices this week and the same happened as last time.

LOL I see a pattern.

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Below is a classic example of what happens to bump traders off.Any longs in at 10550 with a stop loss up to 26 points gets bumped off with a spike.After seeing this happen many times it is the classic "asylum" move that would do anyones head in.Now someone say `oh don`t put your stop loss in an obvious place`.What rubbish.

I didn`t spend a penny on it just enlightening to what can happen before a move either way.Like I said I call it the asylum play.

I didn`t spend a penny on it just enlightening to what can happen before a move either way.Like I said I call it the asylum play.

Attachments

Similar threads

- Replies

- 15

- Views

- 2K

- Replies

- 3

- Views

- 3K

- Replies

- 13

- Views

- 2K