- Joined

- 18 January 2007

- Posts

- 62

- Reactions

- 0

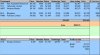

Ok I took the plunge and put my money where my March picks are,

I plan to trade these during the month and will post any changes when they occur. and some reasons why I might sell and or buy, I have allocated a bank of $12,049 real money.

I am already down $286 but what a day on the market it has been, I hope to more than make that up over the next few weeks

I am in no way suggesting that I am expert in this but I am prepared to put my wins and Losses on view to help me and anyone else learn something

I plan to trade these during the month and will post any changes when they occur. and some reasons why I might sell and or buy, I have allocated a bank of $12,049 real money.

I am already down $286 but what a day on the market it has been, I hope to more than make that up over the next few weeks

I am in no way suggesting that I am expert in this but I am prepared to put my wins and Losses on view to help me and anyone else learn something