Dona Ferentes

A little bit OC⚡DC

- Joined

- 11 January 2016

- Posts

- 15,080

- Reactions

- 20,440

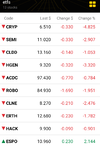

ESPO was admitted to the ASX in September 2020. Currently has about $120million in funds under management. Management fee of 0.55%pa.

The fund gives investors exposure to a diversified portfolio of 25 companies in the global Video Gaming & eSports sector. The fund aims to provide investment returns before fees and other costs which track the performance of the Index.