- Joined

- 27 June 2010

- Posts

- 4,147

- Reactions

- 309

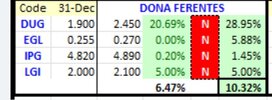

DUG Technology is a technology company providing high performance computing as a service (HPCaaS), scientific data analysis services, and software solutions for the global technology and resource sectors.

DUG provides HPCaaS and Services for scientific data analysis. This includes processing and visualisation of scientific data, and R&D of software and associated algorithms. Any industry that has a need to manage, visualise, and/or process large and complex scientific datasets is a potential client.

Clients can access these products directly or through the DUG McCloud platform, an innovative and collaborative cloud model. DUG McCloud allows people to work together on a project whether they are co-located or spread around the world.

Most of DUG's traditional clients are in the resource sector. However, since 2019 DUG has been providing HPCaaS, scientific data analysis services and software solutions to a broader range of scientific endeavours.

It is anticipated that DUG will list on the ASX during August 2020.

https://dug.com

DUG provides HPCaaS and Services for scientific data analysis. This includes processing and visualisation of scientific data, and R&D of software and associated algorithms. Any industry that has a need to manage, visualise, and/or process large and complex scientific datasets is a potential client.

Clients can access these products directly or through the DUG McCloud platform, an innovative and collaborative cloud model. DUG McCloud allows people to work together on a project whether they are co-located or spread around the world.

Most of DUG's traditional clients are in the resource sector. However, since 2019 DUG has been providing HPCaaS, scientific data analysis services and software solutions to a broader range of scientific endeavours.

It is anticipated that DUG will list on the ASX during August 2020.

https://dug.com