- Joined

- 10 September 2007

- Posts

- 62

- Reactions

- 1

Hi Everyone,

(I wanted to wait till I had the book with me so I could put the page no, but I'm at work so here goes anyways...)

[Caveat: I am a complete novice]

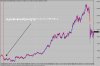

I am reading 'The Way of the Turtle' (Curtis Faith) [I'm about into ch 7] and it shows a graph of the returns using a (standard?) Donchian trend following system from 96-06 based on starting capital of $100K. At the end of the 10 years it is worth 5.5 Mil!!!

Assuming this is a 'standard' system that anyone (with the gumption and minimum intellect) could implement, why isn't everyone doing this now???

The chapter it appears in is explaining that the common affliction in following the system is the times that you need to take large (>50% sometimes) draw downs, and that a lot of people dont stick at it.

I am (very lightly) toying with the idea of lending 100K and doing it myself (possibly using a fund manager), as I think the market has at least another 3-5 good years of growth.

Any thoughts?

Rob

(I wanted to wait till I had the book with me so I could put the page no, but I'm at work so here goes anyways...)

[Caveat: I am a complete novice]

I am reading 'The Way of the Turtle' (Curtis Faith) [I'm about into ch 7] and it shows a graph of the returns using a (standard?) Donchian trend following system from 96-06 based on starting capital of $100K. At the end of the 10 years it is worth 5.5 Mil!!!

Assuming this is a 'standard' system that anyone (with the gumption and minimum intellect) could implement, why isn't everyone doing this now???

The chapter it appears in is explaining that the common affliction in following the system is the times that you need to take large (>50% sometimes) draw downs, and that a lot of people dont stick at it.

I am (very lightly) toying with the idea of lending 100K and doing it myself (possibly using a fund manager), as I think the market has at least another 3-5 good years of growth.

Any thoughts?

Rob