- Joined

- 10 August 2006

- Posts

- 116

- Reactions

- 0

Came across this blog, where the author explains the statistical behavour of markets.

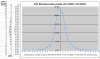

Wrote a little app to do some number crunching of the ASX since 1980, and came up with numbers/corresponding graph which are pretty much identical.

Again from the blog :

For a short term trading system, this could be something to consider. (I haven't done anything with this yet). I guess what made me curious was all the headlines that are getting almost commonplace, regarding winning streaks, esp. for the Dow.

Wrote a little app to do some number crunching of the ASX since 1980, and came up with numbers/corresponding graph which are pretty much identical.

Again from the blog :

For discretionary trader, the statistical behaviour of the underlying instrument is an independent confirmation from his/her usual technical analysis tools. The odds of a reversal from an extreme price level is increased significantly when the distribution reading is confirming the bias.

For a system trader, have you ever used runs distribution as a filter for your trading systems? It is one of the rare tools that can improve a trading system without causing curve fit issues.

In short, if you trade 15-minute time frame, with a long position, then it is pretty obvious that after 3 bars of consecutive higher closes, even if you are not closing out your position, it is very important that you have a proper stop order in place to protect your position.

For a short term trading system, this could be something to consider. (I haven't done anything with this yet). I guess what made me curious was all the headlines that are getting almost commonplace, regarding winning streaks, esp. for the Dow.