G'day all,

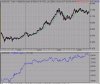

I'm currently playing around with an FX strategy. Without optimising it to the nth degree, it's currently at a stage where the annual return is 55% with a max sys DD of 18%. It's an AUDUSD hourly system, but my current hourly data only goes back to mid-2003. (I'd like someone who has at least 10yrs data to backtest this for me at a later stage)

I've included the Amibroker report and settings below. If you have a moment can you look at it and tell me what you think of the figures in the report. Some figures you'll see are way way out and not possibly correct (net risk adj return %, avg profit %, avg loss %) but this is because of the settings needed for the report to correctly reflect the 100:1 leverage I'm using for this test.

Any thoughts and comments would be greatly appreciated.

Andrew.

I'm currently playing around with an FX strategy. Without optimising it to the nth degree, it's currently at a stage where the annual return is 55% with a max sys DD of 18%. It's an AUDUSD hourly system, but my current hourly data only goes back to mid-2003. (I'd like someone who has at least 10yrs data to backtest this for me at a later stage)

I've included the Amibroker report and settings below. If you have a moment can you look at it and tell me what you think of the figures in the report. Some figures you'll see are way way out and not possibly correct (net risk adj return %, avg profit %, avg loss %) but this is because of the settings needed for the report to correctly reflect the 100:1 leverage I'm using for this test.

Any thoughts and comments would be greatly appreciated.

Andrew.