- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

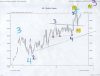

COPPER ............

ANY COMMENTS ?

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

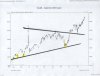

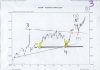

ANY COMMENTS ?

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …