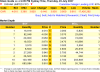

The Market Depth on the CommSec website seems to have a bug where the sell and buy sides are reversed. This is the second time this happened to me, and it seems to only happen around market close and then it goes back to normal. It kinda freaks you out initially...  anyone else seen this?

anyone else seen this?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CommSec website bug

- Thread starter kamil

- Start date

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

Hi kamil,

It's not a bug with comsec.

This link should explain it for you:

http://www.asx.com.au/investor/education/basics/open_Close.htm

It's not a bug with comsec.

This link should explain it for you:

http://www.asx.com.au/investor/education/basics/open_Close.htm

Hi Bob,

Thanks for the link. That doco does explain why there would exist an overlap in buy/sell order price (with acceptance of market orders during suspended trading state). However, with the depth above there was a total reversal, I mean the BUY/SELL columns were in the same spot but Number/Quantity/Price were flipped left to right so that the sell orders were listed under buys, and buy orders under sells!. I may still be missing the point here, but the top sell order is at $3.360 and the top buy is at $4.01?!

Thanks for the link. That doco does explain why there would exist an overlap in buy/sell order price (with acceptance of market orders during suspended trading state). However, with the depth above there was a total reversal, I mean the BUY/SELL columns were in the same spot but Number/Quantity/Price were flipped left to right so that the sell orders were listed under buys, and buy orders under sells!. I may still be missing the point here, but the top sell order is at $3.360 and the top buy is at $4.01?!

- Joined

- 31 October 2006

- Posts

- 739

- Reactions

- 0

Kamil,Hi Bob,

Thanks for the link. That doco does explain why there would exist an overlap in buy/sell order price (with acceptance of market orders during suspended trading state). However, with the depth above there was a total reversal, I mean the BUY/SELL columns were in the same spot but Number/Quantity/Price were flipped left to right so that the sell orders were listed under buys, and buy orders under sells!. I may still be missing the point here, but the top sell order is at $3.360 and the top buy is at $4.01?!

Does this only happen before open and after close? Your depth chart states the time of 4.09pm, this is during the "auction". I reckon the professor is right if this is the case. I have a commsec account and have not experianced any bugs apart from the usual comsec crap.`But must admit, I'm now use to the new design of the site, and it has improved somewhat. I just wish they would confirm trades quicker, some come through 6 hrs after the trade.

Hi Bob,

Thanks for the link. That doco does explain why there would exist an overlap in buy/sell order price (with acceptance of market orders during suspended trading state). However, with the depth above there was a total reversal, I mean the BUY/SELL columns were in the same spot but Number/Quantity/Price were flipped left to right so that the sell orders were listed under buys, and buy orders under sells!. I may still be missing the point here, but the top sell order is at $3.360 and the top buy is at $4.01?!

Kamil, it's just the auction as explained in the link prof gave you. Think of it as the lowest someone is willing to sell for and the highest someone is willing to buy for. Maybe re-read the link, it takes a while to get your head around.

- Joined

- 31 October 2006

- Posts

- 739

- Reactions

- 0

It certainly does. Took me a few days, but after a while you understand what the market is doing, you also get pretty good at estimating the price on open or close.Maybe re-read the link, it takes a while to get your head around.

- Joined

- 31 October 2006

- Posts

- 739

- Reactions

- 0

You may also notice this happening when a company releases an ann while the market is open. Keep an eye out on open, you'll see a bidding war where some push the buy price up so they can get first, and vice versa on the sell side. This, is pretty much how a stock can gap up or down, punters bid, then the market uses a formula to find the going rate for a stock ie. the opening or closing SPThanks guys, I'll warp my head around this eventually... I'll have a look tomorrow for a good before and after example and try to workout what is happening.

Similar threads

- Replies

- 8

- Views

- 796

- Article

- Replies

- 2

- Views

- 1K