greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,462

- Reactions

- 4,502

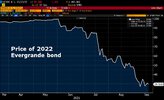

This is starting to get very serious. The Evergrande Group has $300 billion of liabilities and it is increasingly looking like it will default. Some analysts have described the Evergrande crisis as “China’s Lehman Brothers moment”

But the problems with China's property sector look terminal. Ghost cities, overpriced real estate, property development companies failing, projects sitting unfinished. It's all starting to look very untidy, and it could be a major trigger for an economic crisis in China.

Is this the corporate collapse that will kick off a correction on global markets?

But the problems with China's property sector look terminal. Ghost cities, overpriced real estate, property development companies failing, projects sitting unfinished. It's all starting to look very untidy, and it could be a major trigger for an economic crisis in China.

Is this the corporate collapse that will kick off a correction on global markets?