- Joined

- 6 November 2005

- Posts

- 915

- Reactions

- 0

Hi folks,

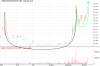

CCU ..... floated today, with an intraday rush of blood,

but failed to hold onto the highs, finishing around 25 cents.

Looking ahead, CCU will probably range-trade sideways,

until October 2006, when we will be alert for some good

news, as several positive time cycles come into play:

14072006 ..... minor and positive (intraday)

24072006 ..... positive news/moves ... finance-related???

2807-01082006 ..... 2 negative cycles here, testing support??

15-17082006 ..... 2 cycles ... news of minor difficulties??

29-30082006 ..... spotlight on CCU, may bring negative news???

..... testing lows again???

11092006 ..... negative and finance-related ... testing lows???

15-18092006 ..... 2 minor cycles here .... ???

29092006 ..... minor

05-06102006 ..... 2 cycles here may bring positive news

2710-01112006 ..... spotlight on 3 very positive cycles here,

may bring an aggressive rally ...???

22112006 ..... first of many negative CCU cycles in

November/December 2006.

happy trading

yogi