Hi

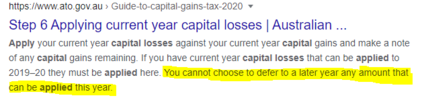

Currently I am working part time. I made a profit of selling a share $5000 and loss of $3000 on other share. Both bought and sold in same year. My annual income is less then $18000 even after including $5000 profit. I didn’t deducted $3000.I will not be paying tax this year as my taxable income is below $18200. Can I carry forward my capital loss $3000 for later year and deduct from capital gains when I have more income?

Can I able to choose which year to deduct capital loss to get maximum tax reduction?

Thanks a lot for the help.

Currently I am working part time. I made a profit of selling a share $5000 and loss of $3000 on other share. Both bought and sold in same year. My annual income is less then $18000 even after including $5000 profit. I didn’t deducted $3000.I will not be paying tax this year as my taxable income is below $18200. Can I carry forward my capital loss $3000 for later year and deduct from capital gains when I have more income?

Can I able to choose which year to deduct capital loss to get maximum tax reduction?

Thanks a lot for the help.