- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,891

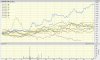

I stayed in cash too long, since December 2009. It looks as if markets may now boom like they never have before - ASX200 is a laggard in the world recovery and may test 10,000 by 2014???

The mining sector is high risk but pointers show it vastly undervalued, however, your smaller stocks may not be keeping up unless they're coal and iron ore related of late??? Small stocks in the mining and oil sector often boom before a major collapse and may well race away, even uranium exploration minnows???

China is set to revalue its currency we're told. If so the USA will be happy bunnies. China shares are set to rocket off the map???

Fill-your-boots me lads and make hay whilst the sun shines???

The mining sector is high risk but pointers show it vastly undervalued, however, your smaller stocks may not be keeping up unless they're coal and iron ore related of late??? Small stocks in the mining and oil sector often boom before a major collapse and may well race away, even uranium exploration minnows???

China is set to revalue its currency we're told. If so the USA will be happy bunnies. China shares are set to rocket off the map???

Fill-your-boots me lads and make hay whilst the sun shines???

???

???