Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,344

- Reactions

- 9,445

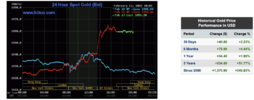

Thanks to Xe, I have again been able to find some tasty charts of BTC/Gold.

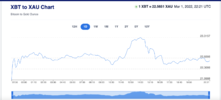

They track how many ounces of gold it takes to buy one bitcoin. I enclose some daily to a yearly chart.

I don't discount crypto btw, it may have some value going forward but not at these prices for me, and I prefer the vibe of ETH were I to jump in. Gold has stagnated somewhat and BTC is in a longer term downtrend.

I mean to say you got to buy something when it gets very cheap when your gold bar starts to appreciate, if it does.

Interesting times.

gg

They track how many ounces of gold it takes to buy one bitcoin. I enclose some daily to a yearly chart.

I don't discount crypto btw, it may have some value going forward but not at these prices for me, and I prefer the vibe of ETH were I to jump in. Gold has stagnated somewhat and BTC is in a longer term downtrend.

I mean to say you got to buy something when it gets very cheap when your gold bar starts to appreciate, if it does.

Interesting times.

gg