- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,596

My whole portfolio is kind of setup to sell little chunks of my winners and allocate them into unloved asset classes.

So last week I was thinking of maybe getting long some energy stocks to get some inflation beta happening in the portfolio, kind of as a hedge against the nonstop rocking performance of my long duration and gold trades (which both do really well in declining real interest rate environments) and any geopolitical shocks with Iran.

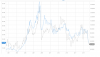

So I use Barchart to pull up the cash WTI and divide it by cash AUDUSD and end up with this chart:

Now let's see what kind of beta our biggest energy stocks have to this:

WPL

STO

ORG

ORG has a little divergence there because there was a takeover offer or something around 2009 I remember.

I'm thinking to myself, if I want I can just buy little baskets of the top 3 and earn some nice dividends to boot instead of buying an oil futs ETF like USO (on the US exchange) and paying for contango, which drains returns. I don't like OOO because it's currency hedged and I like to manage my own currency exposure, and in general commodity ETFs on the ASX suck.

So I start browsing the sites for WPL, STO, ORG and I realise none of them are even oilers! They all sell LNG. Of the big stocks on the ASX, it's only really BHP that actually produces and sells oil.

Since I wanted some copper exposure as well (for other reasons) I was thinking maybe I'll just buy BHP so I never pulled the trigger on the WPL/STO/ORG basket.

Anyway, today I was browsing through Anas Alhajji's twitter feed and saw this thread:

about the impact of the Saudi/Russia oil fight on LNG exporters with oil linked pricing and even insignificant Australia got a mention in tweet 3:

"All LNG companies operating in Australia will be hit especially hard with the oil rout".

Anas is a pretty sharp oil dude, he used to be a regular on MacroVoices Energy Week and I would always perk up when he talked.

Anyway, possibly an interesting thing to discuss so I thought I'd throw up a thread with some charts.

I know @Smurf1976 probably has something interesting to add.

So last week I was thinking of maybe getting long some energy stocks to get some inflation beta happening in the portfolio, kind of as a hedge against the nonstop rocking performance of my long duration and gold trades (which both do really well in declining real interest rate environments) and any geopolitical shocks with Iran.

So I use Barchart to pull up the cash WTI and divide it by cash AUDUSD and end up with this chart:

Now let's see what kind of beta our biggest energy stocks have to this:

WPL

STO

ORG

ORG has a little divergence there because there was a takeover offer or something around 2009 I remember.

I'm thinking to myself, if I want I can just buy little baskets of the top 3 and earn some nice dividends to boot instead of buying an oil futs ETF like USO (on the US exchange) and paying for contango, which drains returns. I don't like OOO because it's currency hedged and I like to manage my own currency exposure, and in general commodity ETFs on the ASX suck.

So I start browsing the sites for WPL, STO, ORG and I realise none of them are even oilers! They all sell LNG. Of the big stocks on the ASX, it's only really BHP that actually produces and sells oil.

Since I wanted some copper exposure as well (for other reasons) I was thinking maybe I'll just buy BHP so I never pulled the trigger on the WPL/STO/ORG basket.

Anyway, today I was browsing through Anas Alhajji's twitter feed and saw this thread:

about the impact of the Saudi/Russia oil fight on LNG exporters with oil linked pricing and even insignificant Australia got a mention in tweet 3:

"All LNG companies operating in Australia will be hit especially hard with the oil rout".

Anas is a pretty sharp oil dude, he used to be a regular on MacroVoices Energy Week and I would always perk up when he talked.

Anyway, possibly an interesting thing to discuss so I thought I'd throw up a thread with some charts.

I know @Smurf1976 probably has something interesting to add.